Why Should Credit Analysts Use AccuAccount?

Understanding a customer's or member's financial health is key to making prudent lending decisions. Credit analysts play an important role in this process, but they need reliable access to credit documentation in order to do their jobs. Although it is frequently used by loan administration teams, AccuAccount can also make life easier for credit analysts.

Here are three reasons why credit analysts should consider using AccuAccount:

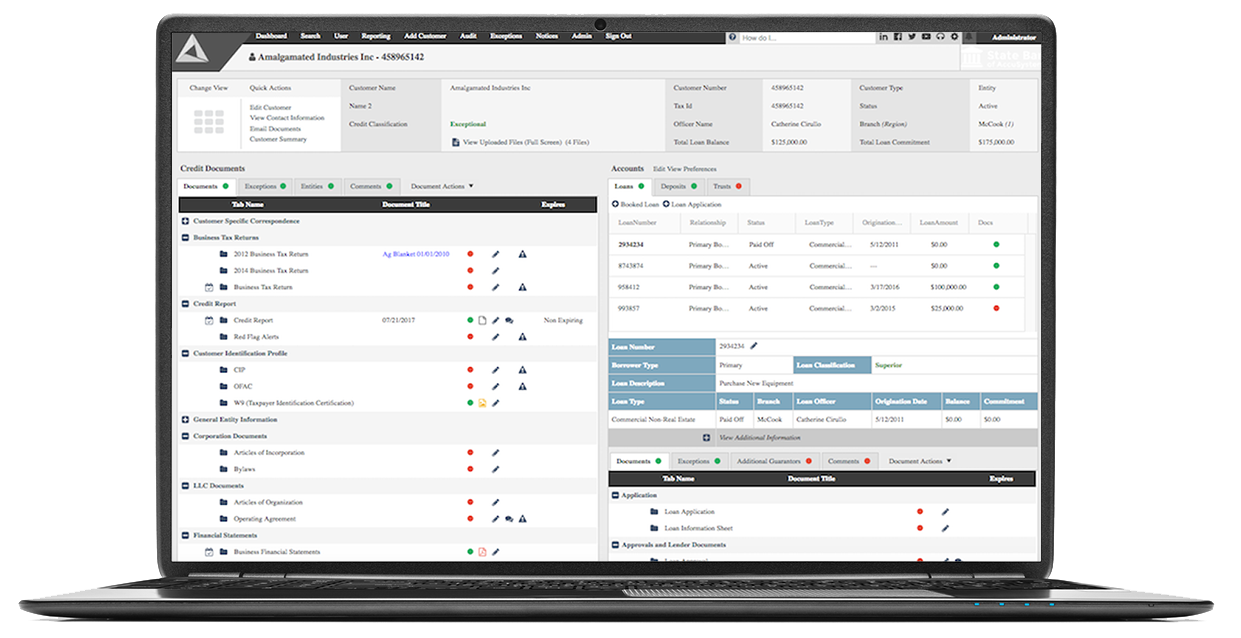

1. Quickly Verify Credit Documentation Has Been Obtained

Credit analysts with proper permissions in AccuAccount can quickly assess each customer or member’s documentation. Color-coded indicators provide a straightforward way to identify missing credit documents, such as business financial statements. Green means that you have it, red means that you still need it.

2. Electronically Access Documents for Credit Analysis

Viewing a document in AccuAccount just requires the click of a mouse. Multiple credit analysts can simultaneously view the same document from different geographic locations—unlike paper loan files. As a result, credit analysts no longer have to pause their work to check interoffice mail or dig through record rooms. Use document view in AccuAccount to search for specific documents by name.

3. Easily Manage Ongoing Credit Exceptions

Not all credit analysis teams are responsible for managing credit exceptions—but some are. AccuAccount offers built-in exception tracking and reporting to support ongoing credit documentation requirements, such as collecting annual tax returns. Receive exception data via email, build custom reports, generate and distribute notices, and automatically clear exceptions by imaging documents.

See Our Credit Document Management Features

Interested in learning more about AccuAccount? We’re happy to provide your team with an in-depth demo of our credit document management features.

Be the first to know! Click below to follow us on LinkedIn for news and content updates!