Alogent Shield+

The Most Robust Check Fraud Protection, Powered by AI and Computer-Vision

For banks and credit unions aiming to strengthen their risk mitigation strategies, Alogent Shield+ offers advanced artificial intelligence and computer vision capabilities specifically designed to combat check fraud across all Day 1 and Day 2 workflows. Seamlessly integrated with Alogent’s comprehensive item processing solutions, ensuring robust fraud protection.

By safeguarding all deposit channels 24x7x365, Alogent Shield+ enables financial institutions to stay one step ahead of fraudsters. Its real-time monitoring capabilities allow for immediate detection of suspicious activities, minimizing potential losses. The system’s extensive database also includes critical information on compromised accounts and known fraudsters, enhancing the overall security framework and empowering institutions to make informed decisions. With Alogent Shield+, banks and credit unions can confidently protect their assets and maintain account holder trust.

Advanced Image Analytics and a

Cloud-Hosted Consortium

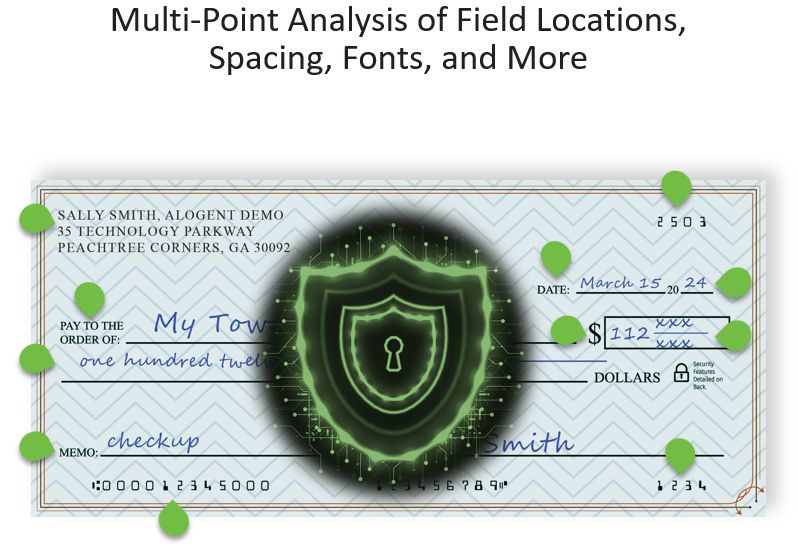

Alogent Shield+ analyzes 24 document attributes in real-time, comparing new checks against existing profiles to streamline manual review and reduce false positives. This cloud-based service enhances fraud prevention by improving check verification efficiency and minimizing losses through a shared database that supports accurate decision-making. Utilizing advanced image analysis techniques to collect information from stolen checks, account screens, and identity documents found on the dark web, Alogent Shield+ also issues alerts for accounts that may be at risk.

- AI-powered and computer vision fraud detection

- Cloud-hosted network

- Real-time decisioning

- Access a consortium of check profiles and financial institution data

Account Holder Scoring Model

Enhance your risk mitigation strategy with Alogent's real-time image and data validation capabilities. Create comprehensive account holder profiles and a user scoring model based on banking history, deposit habits, OFAC lists, and other business rules to optimize user experiences across all deposit channels. By implementing auto-decisioning, treat transactions the same across both full-service and self-service points of capture, effectively detecting anomalies and mitigating fraud. The outcome: reduced friction for users, lower overhead and manual processing, and improved fraud prevention for your financial institution.

Protect Your Deposit Channels with Alogent Shield+

Transition from identifying risks to actively safeguarding your assets across all in-branch and remote deposit channels, inclearings, and X9 deposit files. Learn more about Alogent Shield+ today.

Alogent Shield+ is powered by Mitek Check Fraud Defender