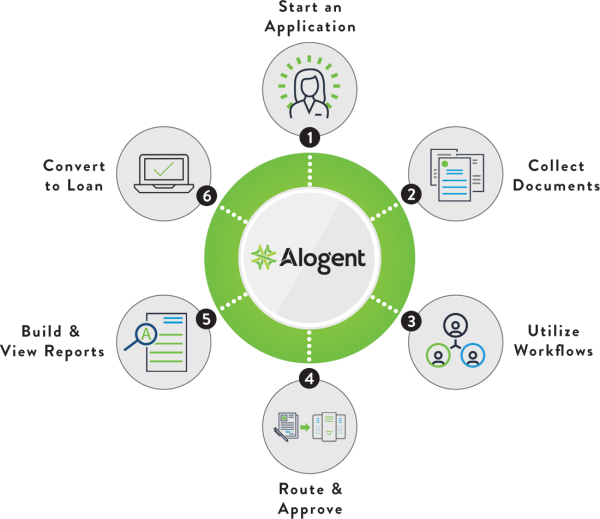

Streamline Your Loan Approval Workflow

AccuApproval turns loan approval into a manageable process in AccuAccount.

Reduce inefficiency, increase collaboration, and accelerate time to close.

Step 1: Start an Application

View Customer or Member Relationships and Start New Applications in a Few Clicks

Access credit documents, loan and deposit information, and relationships for existing account holders, and consolidate customer and member information from multiple sources. Track potential account holders and lending opportunities in a scalable, flexible system. Connect to your CRM, LOS, and other systems for additional efficiency.

Step 2: Collect Documents

Collect Your Documents and Display Them Intuitively

Stop waiting on paper documents to arrive on your desk. Share documents with other users and departments as they are received. Credit documents and applications are organized and instantly available to other users and teams, which speeds up the approval process.

Step 3: Utilize Workflows

Use Workflows that Mirror Your Lending Process

Automate each step to mirror your current lending process. Works with all of your loan types: commercial, mortgage, lines of credit, agricultural—even renewals. Track changes in the application status. Users or groups receive email notifications when action is required. Management can check on statuses at any point in time.

Step 4: Route & Approve

Electronically Route and Approve Loans

Emails notify credit analysts, underwriters, doc prep, and others to take action and process the application in a timely manner. Loan processors, lenders, managers, and admins can be notified each time a step is taken. Utilize approval limits or allow committees to mark applications as approved or denied.

Step 5: Build & View Reports

Easily Track Application Status and Lender Productivity

Gain a high-level view of your loan pipeline with customizable dashboards and reports. Keep management informed about pipeline value, profitable opportunities, and other important metrics. Get reports by branch, lender, loan product, application status, and much more.

Step 6: Convert to Loan

Easily Convert Applications and Retain all Relevant Information

Convert applications to booked loans in seconds. Retain the application's history and documents on the newly booked loan. Withdrawn and declined applications are retained for historical purposes.

TAKE THE NEXT STEP

AccuApproval is a powerful add-on to AccuAccount. Learn more about what it can do for your bank or credit union.

Watch our video or pre-recorded webinar to learn more.

No Registration Required: AccuApproval Demo

Watch a 13-minute pre-recorded demo about AccuApproval for AccuAccount.

No Registration Required: AccuApproval Intro

No Registration Required: Equitable Savings and Loan Testimonial

Questions?

AccuApproval FAQs

SEE OUR SOFTWARE IN ACTION

Watch an on-demand demo of AccuAccount. Learn how our software integrates to 30+ core systems and loan origination systems, streamlines imaging, and automates exception tracking and audit preparation for 32,000+ bankers.

Free Printable PDFs

Loan Management Resources

[eBook] Case Studies

Download a free case study eBook to learn why these community banks opted for AccuAccount instead of core-provided modules.

AccuApproval Whitepaper

Access our AccuApproval technical whitepaper to learn more about features and capabilities.