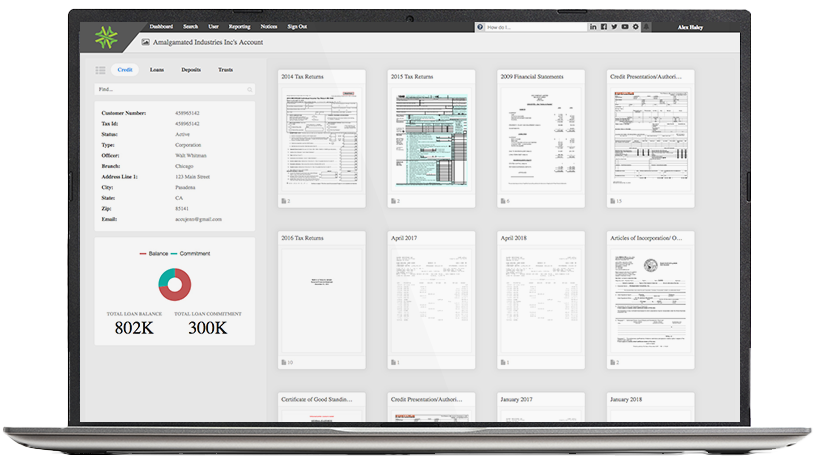

All of Your Documents from All of Your Customers, Members & Accounts

Manage customer, member, loan, deposit, trust, and back-office documents in an intuitive, core-integrated document imaging system that’s built for banks and credit unions.

DOCUMENT MANAGEMENT

View and Share Documents in a Variety of Ways

Enable users to view documents in ways that streamline their jobs. "Document view" provides lenders with a visual way to explore and search customer and member documents. "Teller view" gives tellers and front-line staff the quick answers they need to support their account holders. "Customer view" provides a 360-degree perspective for back-office and administrative staff.

NEW ACCOUNT SCANNING

Scan and Index a Massive Stack of Paper in Minutes, Not Hours

Accelerate customer, member, and account onboarding with barcodes and batch scanning. Barcoded documents simplify the preparation of loan files and speed up scanning. Use accuimg to efficiently manage batch-scanned documents, attorney-prepared loan files, financial statements, applications, and much more. Spend fewer resources and less time scanning documents.

TRAILING DOCUMENTS

Drag and Drop PDFs, Images, and Email Attachments

Simplify the management of trailing documents, such as quarterly and annual financial statements from account holders, tax returns, flood zone determinations, deeds of trust, UCCs, and insurance. Exception reports help you identify trailing documents that are missing. Drag and drop electronic files into an intuitive user interface.

THIRD-PARTY INTEGRATIONS

eSign, LOS, and Other Tools

Automatically pull in documents directly from your LOS (loan origination system) or eSign products through a nightly process. Easily drag and drop documents from your portal to AccuAccount. Enable an easier way to collect documents from account holders. Reduce paper at every step of the process and increase customer and member satisfaction.

CORE INTEGRATION

Streamline Document Management with Integration to 30+ Core Systems

Eliminate manual data entry by integrating AccuAccount to your core banking system. As new customers, members and accounts are booked to the core, AccuAccount automatically creates placeholder records. Know exactly where each document should go without relying on manual ticklers, spreadsheets, and checklists. Gain a structured approach to document management.

TRACKING & REPORTING

Integrate Imaging and Tracking for Greater Efficiency

Built-in document tracking maximizes the impact of your imaging workflow. Exceptions automatically clear as new documents are scanned or uploaded into AccuAccount. Trigger new exceptions automatically based on the customer, member, or account type. Data-driven exception reports and email alerts keep everyone informed. Build reports by officer, account type, and other criteria with Dynamic Reporting in AccuAccount.

Additional Imaging Resources

Take the Next Step

From quality control to participations to audit and exam prep, we've only scratched the surface of what AccuAccount can do for your financial institution. Watch a pre-recorded webinar, download a whitepaper, or check out our FAQs to learn more about our software.

No Registration Required

Watch a 30-minute pre-recorded demo about AccuAccount’s imaging solutions.

No Registration Required: Core vs. AccuAccount

No Registration Required: Integrations Overview

No Registration Required: You're a Loan Admin...

No Registration Required: CTS Testimonial

Questions?

Imaging FAQs

SEE OUR SOFTWARE IN ACTION

Watch an on-demand demo of AccuAccount. Learn how our software integrates to 30+ core systems and loan origination systems, streamlines imaging, and automates exception tracking and audit preparation for 32,000+ bankers.

Free Printable PDFs

Document Imaging Reports

Study of 103 Bankers

Learn how 103 other bankers approach document imaging. Imaging insights from real bankers.

Six Case Studies

Download a free case study eBook to learn why six community banks opted for AccuAccount instead of core-provided modules.