Efficiently Working through Exceptions with “Staged” Notice Letters

Minimizing exceptions is an important goal to strive for in banking. After all, exceptions indicate a variance from the norm—such as when insurance documents expire or commercial borrowers forget to submit tax returns. Unresolved exceptions create risk for the bank or credit union, and, without proper follow-up, can lead to issues during exams and audits.

Equipping your financial institution with the right technology makes it easier to stay ahead of exception-related risks. AccuAccount, Alogent’s ECM solution that’s optimized for commercial lending, offers robust exception management capabilities—including an intuitive notice letter workflow.

Here’s a quick overview of staged notice letters in AccuAccount.

What are “Staged” Notice Letters?

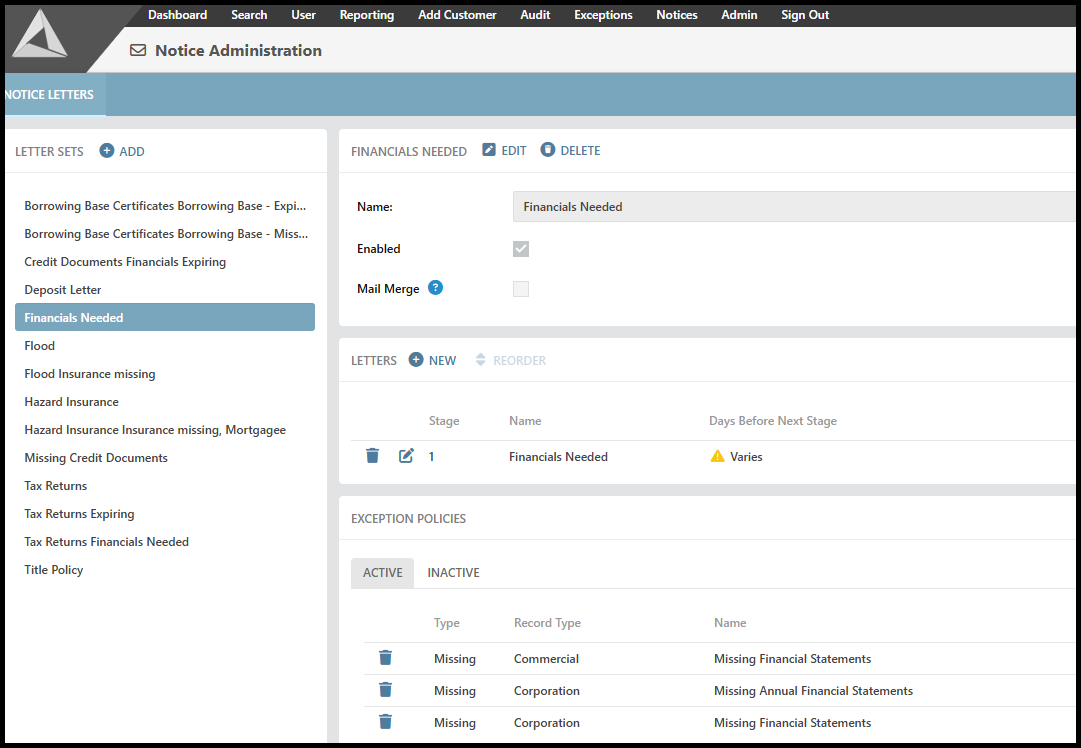

With AccuAccount, financial institutions can easily create multi-stage notice letter sets to support their exception management activities. For example, a bank might create a notice letter set for collecting financial statements from commercial borrowers. Each stage can be customized with a different letter template and distribution schedule.

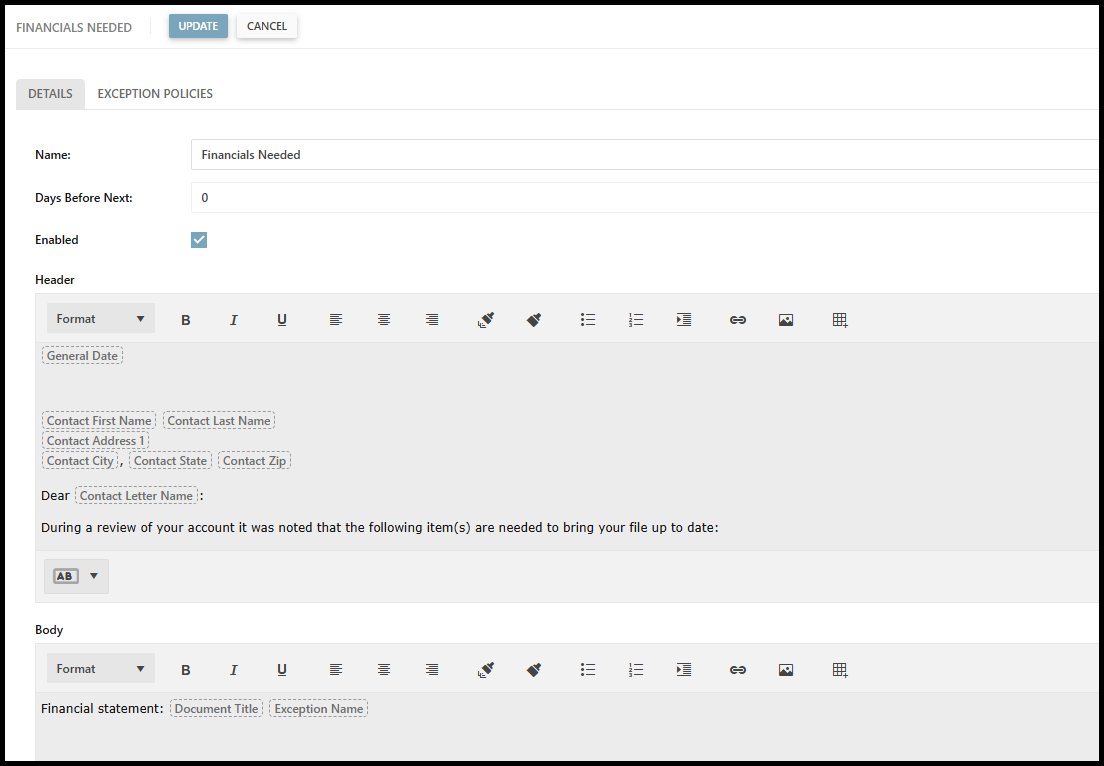

The WYSIWYG editor in AccuAccount simplifies notice letter creation. Use merge fields to pull in customer or member-specific data, such as a borrower’s name or loan officer.

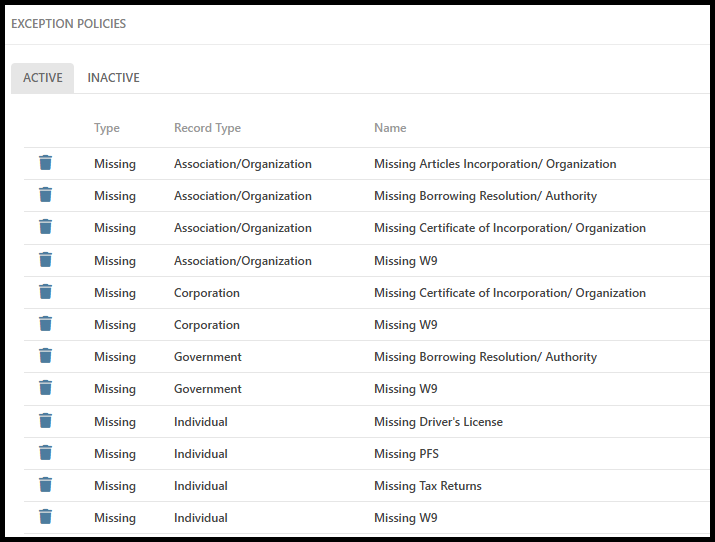

Multiple exception policies can be tied to each letter set, thereby reducing redundancy and streamlining administrative oversight.

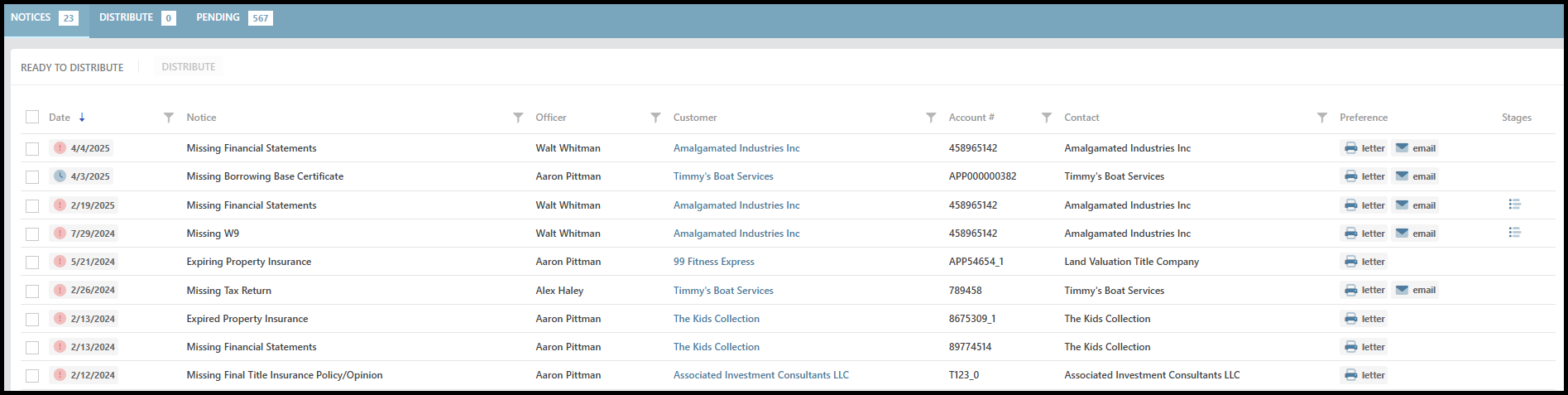

Printing and/or emailing notices is straightforward in AccuAccount. Simply filter by customer or member name, select the letters you’d like to send, and follow the prompts.

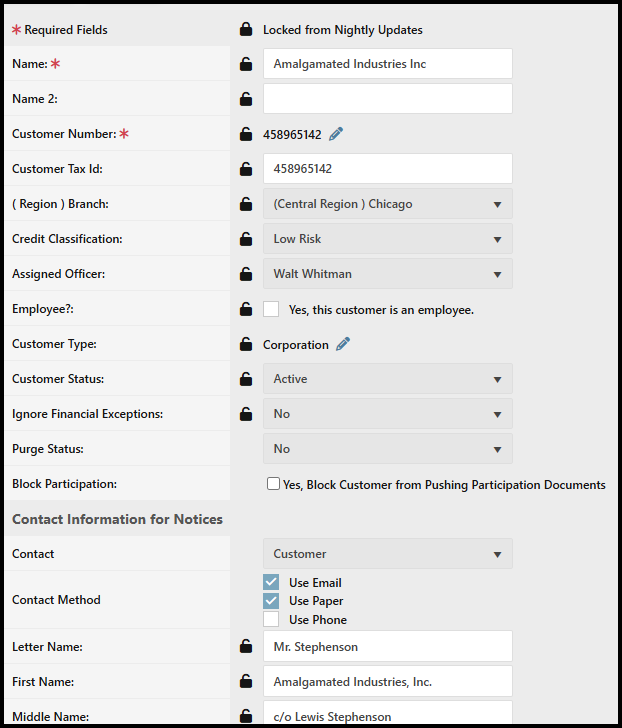

Need to opt-in an account holder for email notices? Visit the customer or member’s page in AccuAccount and adjust the communication settings. Marking an account holder as “do not contact” is also possible.

Benefits of Taking a Staged Approach

Using AccuAccount to send staged notice letters can benefit your financial institution in a variety of ways:

Efficiency: Calling hundreds of customers to request documentation isn’t feasible for most banks or credit unions. Establishing a scalable notice process with AccuAccount provides a customizable, cost-effective method for requesting important information.

Compliance: Building multiple touchpoints into your follow-up sequence helps demonstrate due diligence. Notice letter history is accessible from each customer or member’s page in AccuAccount.

Branding: Staged letters make it possible to communicate an increasing sense of urgency with each point of contact. The WYSIWYG editor provides an easy solution for customizing letters with your institution’s logo and brand elements.

Account Holder Experience: Combining multiple exceptions into a single notice reduces the potential for unnecessary friction. Including portal URLs in your notices encourages action.

Contact us to learn about notice letters in AccuAccount

Explore additional exception management features from Alogent

Webinar on-demand: Mastering Compliance with Staged Notice Letters

Be the first to know! Click below to follow us on LinkedIn for news and content updates!