Increasing Visibility for Your Commercial Loan Pipeline with AccuApproval

Effectively managing a commercial loan portfolio requires the right mix of people, processes, and systems. Even then, important information can still fall through the cracks, making it harder to respond to borrowers’ needs.

For banks and credit unions seeking improved transparency for their commercial loan pipelines, Alogent offers AccuApproval for AccuAccount. AccuApproval is a simple, yet powerful loan application routing and approval tool that automates inefficient workflows (like paper routing sheets).

Let’s take a look at how AccuApproval can streamline commercial lending.

Bring Clarity to Your Commercial Loan Pipeline

AccuApproval and AccuAccount combine to form a comprehensive solution that makes life easier for lenders, credit analysts, underwriters, support staff, and even senior management. Here’s how:

Intuitive Routing & Approval: Starting a new application takes just a few clicks and keystrokes. Routing the electronic application to an analyst or underwriting team is fast and easy, too. AccuApproval automatically tracks assigned users, reducing the chance that an application will be overlooked.

Accountability Features: Dashboard reports in AccuAccount remind staff to take action on pending applications. Timers track how long applications have remained in specific stages (such as credit analysis) as well as total time since creation. Histories provide detailed, chronological insights for each application’s progression. See who took action, what was done, and when.

Document & Exception Management: Imaging features allow staff to digitize, organize, and store credit and loan documents throughout the entire lending process. Built-in exception management simplifies document tracking and reduces manual data entry.

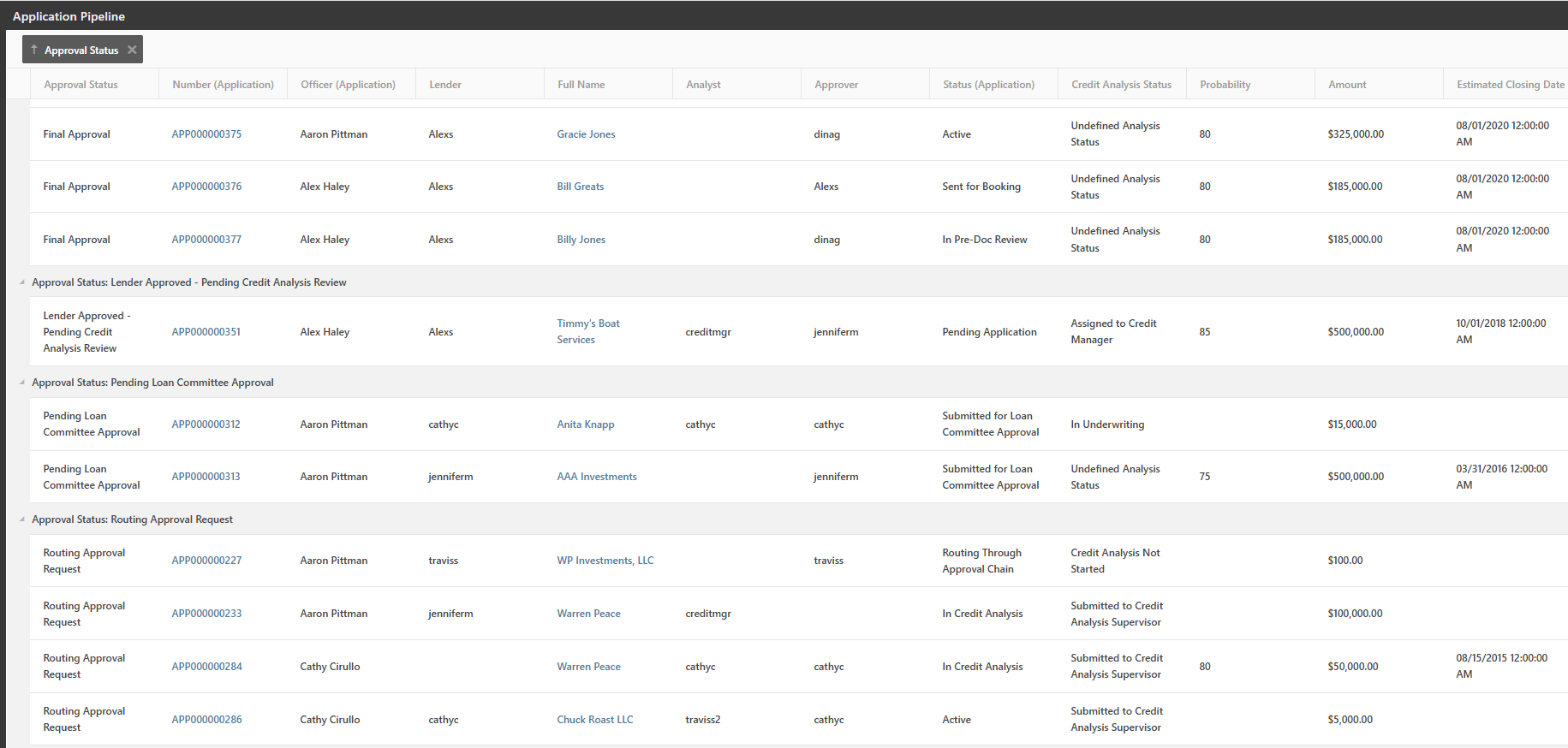

Pipeline Reporting: Dynamic Reporting in AccuAccount empowers users to build, view, and share customizable pipeline reports. Analyze potential loans by status, value, or assigned lender in an easy-to-use reporting experience.

LOS Interfaces: AccuApproval is not an LOS (loan origination system), but connecting your existing LOS (if you have one) to AccuAccount can enable even greater efficiency. Automatically import data and images into AccuAccount and streamline post-booking tasks.

See AccuApproval in Action

Request a free demo of AccuApproval

Watch a brief overview to learn more

Be the first to know! Click below to follow us on LinkedIn for news and content updates!