How to Boost Efficiency & Compliance with a Streamlined Notice Letter Workflow

Notice letters are a necessary part of banking. Whether you’re requesting updated financial statements from individuals or notifying insurance agents of expiring coverage for a batch of loans, notices provide a structured way to follow up with multiple stakeholders at the same time. Here’s the problem: Notice letter generation can be time-consuming and tedious, especially if your bank relies on manual ticklers and spreadsheet checklists. Let’s explore a more efficient (and compliance-friendly) process for notice letters.

Why Notices are Such a Pain for Banks and Credit Unions

Simply determining who should receive a notice letter can be difficult—especially when document exceptions are tracked in spreadsheets or tickler systems that offer minimal reporting capabilities. Even when exception data is reliable and accessible, special circumstances add another layer of complexity. Let’s assume that one of your commercial lenders is scheduled to meet with a large customer who owes your bank a few documents. The lender has already arranged to obtain the documents during the on-site meeting. Sending a notice letter could make your bank—and the lender—appear out of touch. Unfortunately, this situation is hard to avoid when notices are generated by a back-office team that lacks proper context. Finally, the minutiae of preparing, printing, and distributing notices can be incredibly counterproductive. Imagine staring at a spreadsheet containing hundreds of rows of entries that must be manually converted into notices. That’s a lot of time spent clicking “File>Save As…” and “File>Print…” Is this the best use of anyone’s time? Probably not, but someone has to do it.

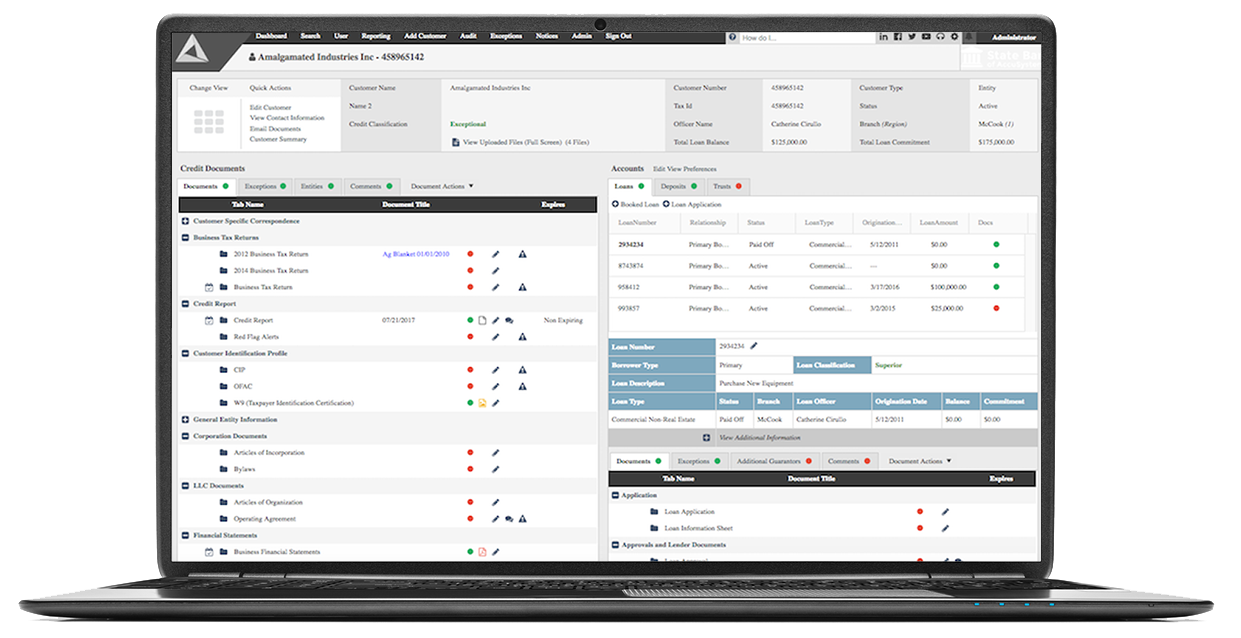

Simplify Your Notice Letter Process with AccuAccount

AccuAccount was built for the specific needs of banks and credit unions.  That’s why all AccuAccount plans include our notice letter automation features. Here’s what you can expect with AccuAccount:

That’s why all AccuAccount plans include our notice letter automation features. Here’s what you can expect with AccuAccount:

Combine multiple exceptions into one letter: Customers don’t want to receive a huge packet of letters in the mail. Make life easier for customers, use less paper and ink, and reduce postage expenses by combining multiple requests into a single letter.

Connect individual exceptions to a specific notice letter: There’s an exception to almost every rule. And, banking exceptions are no exception. (Ha!) AccuAccount provides additional flexibility to tie individual exceptions to specific notice letters—instead of combining these into a single, general notice letter.

Standardize your notice generation workflow: Make notice-related VLOOKUPs and mail merges a thing of the past. AccuAccount synchronizes nightly with your core, which means customer and account-related data can be brought straight into your letter. Simply click “generate notices,” and AccuAccount creates the notices and inserts relevant information into the letters. Almost instantly, you’ll see a preview screen to do a final review before printing. You can also export the file to your computer, make changes, and save it as a PDF to record which letters were mailed. Once you’re done, AccuAccount adds a time-stamped notification to each exception record, indicating that a notice was generated. That’s a handy feature, especially when it comes to dealing with examiners.

Avoid asking for documents that customers already provided: Tracking exceptions in AccuAccount helps you ask for the right documents from the right people, every time. Once a document is obtained from a customer and added to the system, AccuAccount clears the exception automatically—along with any related notices. This means you don’t have to worry about accidentally asking customers for something they’ve already provided.

Send notice emails, too: Recently, we added the ability to send email notices—in addition to (or instead of) paper notices. Email notices offer numerous benefits, especially when you consider that they’re trackable and require no paper, ink, envelopes, and postage. Better yet, you can embed a link to your document portal so customers can easily upload electronic documents. That’s a big deal, especially as the nation continues to deal with COVID-19.

Need a Better Approach to Notices?

Streamlining your bank’s notice letter generation workflow might seem like a relatively low priority. That’s totally understandable, especially in today’s competitive banking environment. But, there’s also a real cost of maintaining the status quo. Let’s work together to simplify your notice letter process. At Alogent, we help banks and credit unions leverage technology and gain efficiency–even when it comes to notice letters. Talk to our experienced team to learn more about our capabilities or schedule a demo.

Be the first to know! Click below to follow us on LinkedIn for news and content updates!