Exception “Spring Cleaning”

It finally feels like spring. The snow has mostly melted, and things are beginning to look a little greener. The trees are starting to blossom, and I’ve even seen a few flowers peeking through the ground. It’s an exciting time of year. Spring’s arrival represents an excellent opportunity to shake out the dust that’s built up during the cold days of winter. And, I’m not just talking about the dust bunnies under your couch at home. Your bank or credit union, too, could probably use a good deep cleaning of sorts. Don’t pull out your feather duster just yet. Today’s article discusses a different type of “dust” - that is, your lending exceptions. If you’re ready to clean up your exception mess once and for all, follow these three steps.

1. Identify the Source of the Mess

As you look at the overwhelming list of missing and expired documents, it’s easy to get frustrated and not know where to begin. Sure, working through each exception one by one is better than doing nothing, but how can you prevent this situation from happening again in the future? If you’re using spreadsheets, manual tickler systems, or your core to track exceptions, you may not have many options. The problem with a manual exception tracking process is obvious: it’s manual. Manual processes require human involvement at every step. Unfortunately, your lenders are far too busy closing loans to stay on top of document tracking details. As your bank’s Exception Specialist, you do your best to keep everything organized, but there are just so many things to stay on top of:

- Logging exceptions into the system

- Clearing satisfied exceptions

- Preparing exception reports

- Keeping track of who needs which report (and when)

- Distributing exception reports

You’re not the cause of the mess, but you sure have found yourself in the middle of it. Clearly, your bank or credit union needs a better workflow for tracking loan exceptions. Sadly, you’re just too busy operating the system to ever have time to improve it.

2. Look for a Cleaner System

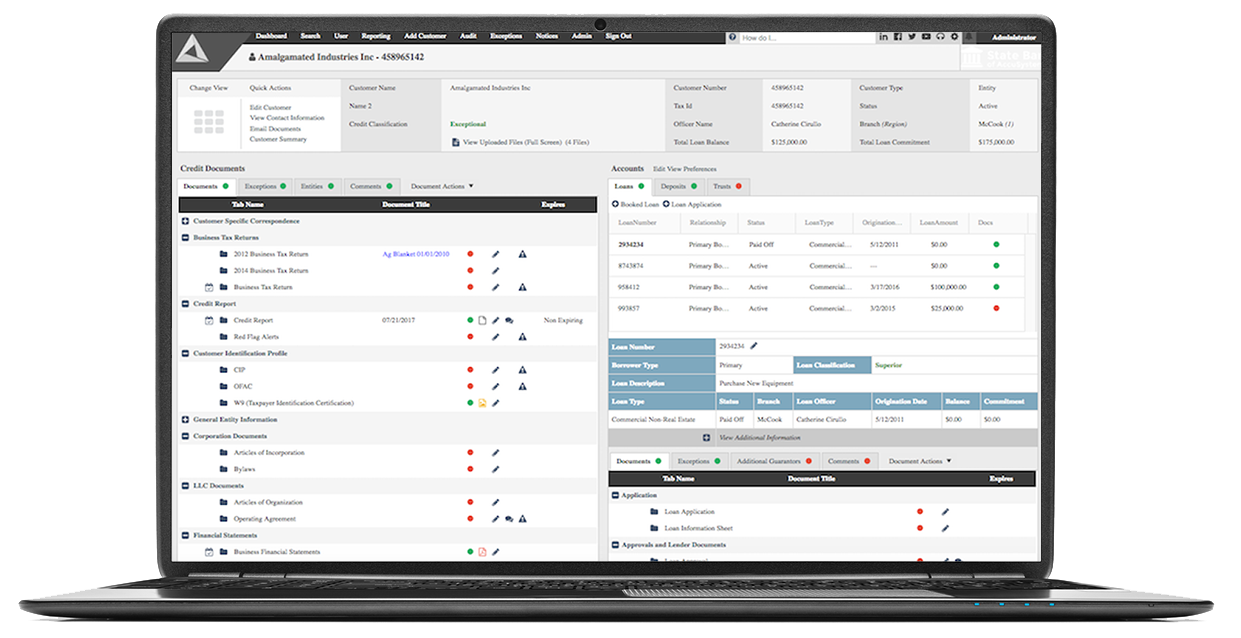

Allow me to shed a little bit of sunshine on your day. Manual ticklers or spreadsheets aren’t the only option for community banks. Our AccuAccount platform was designed specifically to make your job easier. Unlike manual processes that isolate document tracking and storage into separate silos, AccuAccount integrates imaging and exception management under one roof. As a document is scanned into the system, AccuAccount automatically clears the exception with no further action required by you. Better yet, AccuAccount democratizes access to customer and account information, enabling your bank to decentralize many of the responsibilities that fall onto your shoulders. For example, when a customer shares an updated document with a lender, the lender can easily scan and upload it to the customer’s file in AccuAccount.

No more emailing attachments or routing paper documents via interoffice mail to a centralized location for processing and tracking. AccuAccount empowers more users at your bank or credit union, which alleviates your stress level and prevents dust - I mean exceptions - from settling in the first place.

3. Get Cleaning

Simply acquiring an integrated document tracking system doesn’t resolve your exception mess. Any system, no matter how powerful, requires a well-coordinated transition plan. After deciding to move forward with a particular bank exception system, it’s time to get serious about your migration plan. We've guided hundreds of banks and credit unions through successful migration plans. In many cases, we see banks and credit unions follow these steps when transitioning from manual ticklers to an automated system like AccuAccount:

Defining Your Exception Rules - AccuAccount allows you to define exception rules for different types of customers and accounts. So, for example, when a new commercial real estate loan is booked to the core, AccuAccount will automatically check to make sure all of the correct documents are in the file, such as construction contracts, contractor invoices, SBA documents, and other related information. If something is missing, exceptions will begin to show up in your reports with no action required by you.

Validating Exceptions Against Your Current System - Taking a gradual, phased-in approach is often the best way to transition off of a manual tickler or spreadsheet. AccuAccount pulls live data from your core on a nightly basis, making it easy to validate your new reports against information that resides in your legacy system. Use your prior reports as a safety check to ensure everything is working properly in the new system.

Onboarding Scanning Users - There is arguably no better way to scale your tracking process than by onboarding more users with scanning permissions. Empowering lenders and front-line staff to scan and upload customer information reduces bottlenecks and, in turn, minimizes unnecessary exceptions.

Building Automated Reports - Manually preparing one-off reports for lenders and senior management is not the best use of your time. A system like AccuAccount can automate your entire reporting process, ensuring each user receives the exact information they need when they need it most. Read more about how to configure automated exception reports in AccuAccount.

Avoid Future Messes with AccuAccount

Exceptions can be messy, especially when you’re using spreadsheets and manual ticklers. A system like AccuAccount can help your bank or credit union avoid exception messes from ever happening in the first place. To see how AccuAccount can deliver a cleaner approach to exception management, contact us today for a live demo.

Be the first to know! Click below to follow us on LinkedIn for news and content updates!