Customer Identification Program (CIP) Recordkeeping

“A bank’s CIP must include recordkeeping procedures.” ~Bank Secrecy Act Anti-Money Laundering Exam Manual Federal Financial Institutions Examination Council Since the passage of the USA PATRIOT Act, all banks have been required to keep a written CIP. As I’m sure you know, the point of the CIP (Customer Identification Program) is to ensure that banks take reasonable efforts to know the true identity of the customers they serve. Although the CIP requirements can vary based on a variety of factors (including the institution’s asset size, accounts offered, geographic location, etc.), the FFIEC asserts that certain minimums must be collected from each customer before opening an account:

- Name

- Birthdate (for individuals)

- Address

- ID number

Not only must banks and credit unions collect and verify this type of identifying information, but they’re also required to retain certain pieces of customer information. As the FFIEC points out, “...at a minimum, the bank must retain the identifying information (name, address, date of birth for an individual, TIN, and any other information required by the CIP) obtained at account opening for a period of five years after the account is closed.” It’s also worth noting that “...the definition of ‘customer’ also does not include an existing customer as long as the bank has a reasonable belief that it knows the customer’s true identity.”

The Downsides of a Paper-Only Approach to CIP

Clearly, banks have a lot to keep organized when it comes to “knowing the customer.” And, with hundreds or even thousands of individuals and entities to serve, it’s no wonder why many financial institutions struggle to manage their CIP-related documentation. Maintaining a paper-based approach to CIP recordkeeping only compounds the following challenges:

Accessibility: Your bank has dozens of branches, but paper documents can only reside in a single location. If your records room is at the main branch, how can a lender 30 miles away access the info he needs to effectively serve his customers? Couriers, anyone?

Friction with the Customer: Customers don’t enjoy filling out unnecessary paperwork. When CIP documentation is held exclusively in hard copy format, the chances of duplicated effort increases. This creates an unpleasant experience for your customers, and it may even negatively impact their perceptions of your bank.

Unnecessary Risk: What would happen if a portion of your closed account records were lost, damaged, or destroyed? It may be an unlikely scenario, but when everything is only in paper format, it’s a possibility nonetheless.

Painful Exams: Let’s be honest - examiners don’t like digging through paper file folders any more than you do. Paper documents lead to more exceptions, longer exams, and a more painful experience for everyone involved.

Digitizing Your CIP Recordkeeping Process

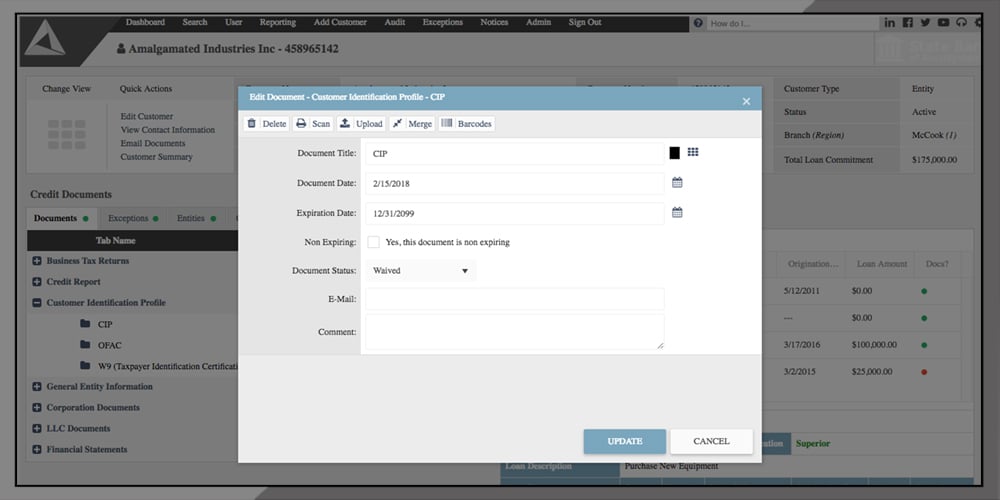

There is a better way, of course. Our AccuAccount platform was designed for community banks of all sizes. With AccuAccount, you’re able to manage every aspect of CIP recordkeeping. For starters, users with proper access can search for customers and entities and quickly determine if the proper CIP documentation has already been collected. Documents are linked to the customer’s profile and can be viewable from any device connected to your bank’s server.

For new customers, just scan in the appropriate documents to clear any pending exceptions.

AccuAccount also tracks missing CIP documents via its exception reporting capabilities. Report subscriptions can also be configured, ensuring your new accounts team stays on top of CIP-related issues before they become a problem. And, while you’re at it, our AccuDoc platform is a great place to save copies of your actual CIP policy. If you ever update or modify your Customer Information Program, you’ll have a dedicated module to view past copies and collaborate with your team.

Simplify Your Bank’s CIP Management Workflow

Relying on a paper-only process for your CIP is a disaster waiting to happen. Explore the possibilities that AccuAccount has to offer your bank. Schedule a 15-minute demo with one of our banking experts today!

Be the first to know! Click below to follow us on LinkedIn for news and content updates!