How to Prepare for a Virtual Audit

Preparing for audits and exams can be incredibly stressful—and time-consuming. That’s especially true when your bank still relies on paper loan files, manual ticklers, and spreadsheets. Simply gathering the requested files into one massive pile is your first hurdle. Lending has one file, underwriting has another, and a third file conveniently goes missing. That means a lot of emails and phone calls just to gather the basic information. Then, the real work begins. Someone—probably you—must go through each file and ensure all of the documentation is in order before the auditor arrives. More emails, phone calls, and busywork that diverts you from focusing on what you do best. Simply put, the traditional way of preparing for audits isn’t very efficient. And, in a world that’s still impacted by COVID-19, banks and auditors alike are looking for ways to enable virtual audits. But, stacks and stacks of hardcopy files make virtual audits very difficult or impossible. Here’s some good news for community banks. Audit and exam prep can be so much easier—and faster—with AccuAccount. Here’s how to get started with virtual audit prep.

Point & Click: Preparing for a Virtual Audit with AccuAccount

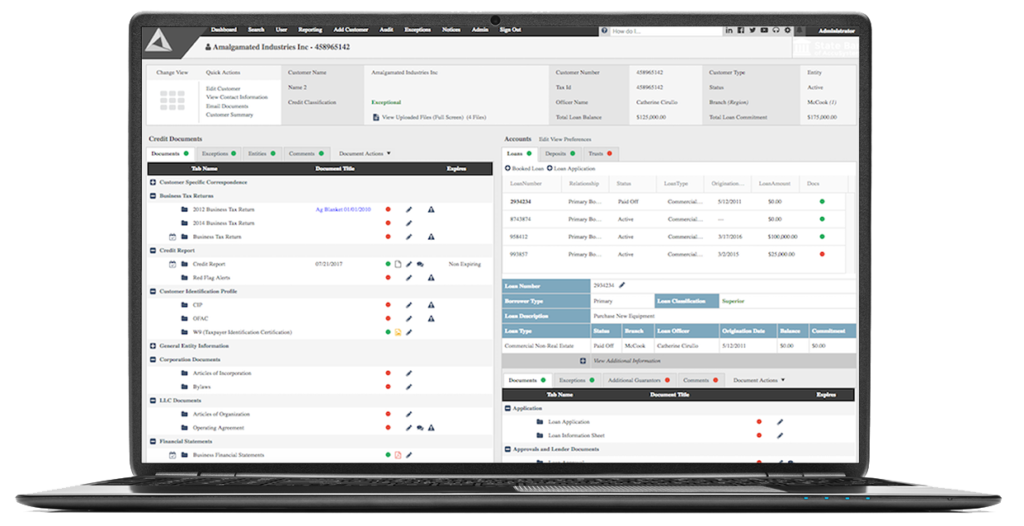

Our AccuAccount software is best known for being a core-integrated document management system that enables banks to easily scan, organize, and find important records. Being able to quickly locate information is key in today’s competitive banking environment, especially when it comes to audit and exam prep. Storing your documents in AccuAccount enables instant digital access to credit and loan documents. Information is organized in an intuitive way that “looks like” a traditional loan file—credit on the left, loans and accounts on the right.

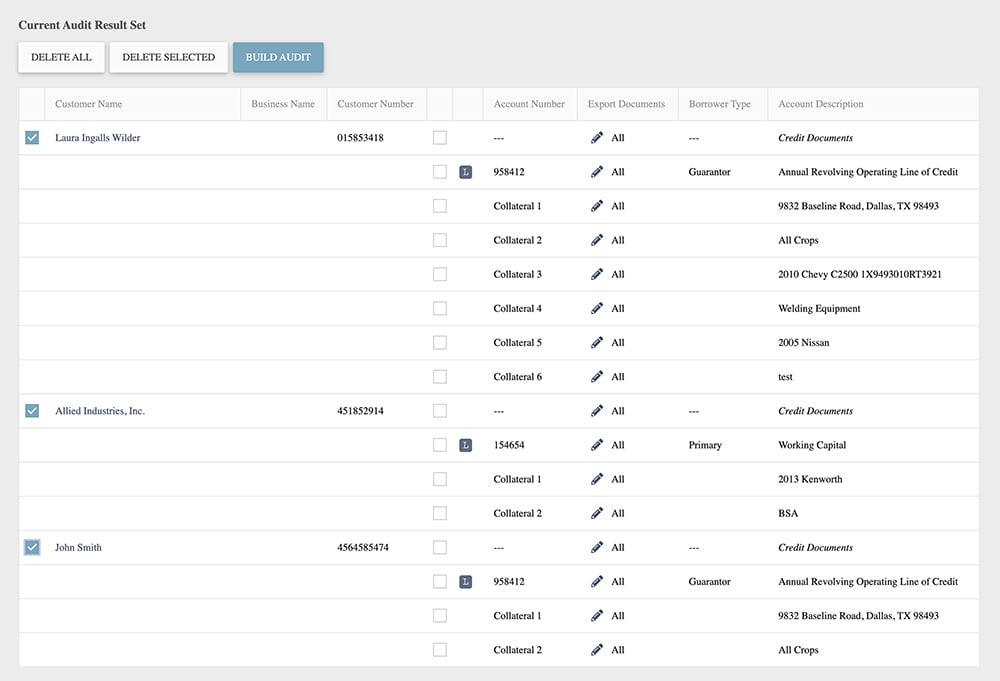

You’ll then be able to build an electronic audit file within our intuitive user interface. Simply find and add the requested information to your electronic audit file. Need to step away for a minute? AccuAccount saves your changes, allowing you to pick up where you left off.

Including collaterals and additional guarantors in your audit file is also easy with AccuAccount.

At any time, you can go back through the records and check for anything that may require action. Color-coded indicators make it easy to spot missing records prior to your audit or exam.

Sharing your virtual audit is also easy. Many of our customers will upload their audit file directly to the auditor’s or examiner’s secure file sharing service. Some prefer using thumb drives or CDs. Either way, auditors can begin reviewing the files as soon as they receive your virtual audit—without having to install or configure special software.

Virtual Audits are Good for Banks, Auditors, & Examiners

In addition to saving your back-office staff considerable amounts of time, using AccuAccount Audit Export delivers a number of tangible benefits:

- Happy Auditors & Examiners: AccuAccount was built with the end user in mind. Auditors and examiners don’t have to click through confusing file structures to find what they need. Everything is neatly organized for each customer, which makes their job easier and more enjoyable.

- Efficiency in an Increasingly Digital World: COVID-19 accelerated the pace at which banks embrace innovative technology. Using Audit Export in AccuAccount allows banks to streamline a process that became even more difficult due to physical distancing requirements and decreased travel.

- Cost Savings: Bringing auditors on-site is not free. Travel, meals, and hotel expenses quickly add up. Leveraging technology to enable virtual audits can represent a tangible cost savings opportunity for financial institutions.

Check Out Our Latest Enhancements to Audit Export

Interested in learning more about Audit Export? Contact us to schedule a personalized demo for your bank. By the way, here’s a quick video that provides additional information about audit prep features:

Be the first to know! Click below to follow us on LinkedIn for news and content updates!