Exception Tracking: Is Now the Right Time to Upgrade Your Workflow?

Documentation and follow-up tasks for financial institutions to manage is commonplace—especially for banks and credit unions involved in commercial lending. Proactively tracking missing and expired documents is a key step for mitigating risk, ensuring compliance, and supporting the customer or member experience.

What’s the best way to manage exceptions? Spreadsheets are a popular choice but present numerous challenges. In this article, we’ll explore why some financial institutions are moving beyond spreadsheets and enhancing their exception tracking workflows.

Spreadsheets: The Good & The Bad

Tracking exceptions in spreadsheets requires minimal or no upfront investment in new software or infrastructure. In addition, users can easily build and implement simple tracking processes without having to learn new tools. Most users already know how to input data into spreadsheets, which helps with user buy-in and adoption—at least initially.

However, spreadsheets leave a lot to be desired when it comes to exception management. Our team at Alogent has worked with many financial institutions that manage their exceptions with spreadsheets. In our experience, spreadsheets fail for several reasons:

Manual data entry: Data quality is difficult to guarantee when information is inputted by many users across the institution. Exceptions must also be manually cleared, which opens the door to oversights and more bad data.

Information loss: Accidentally overwriting or deleting a single row, column, or cell could make a huge impact on the exception data reliability. Unfortunately, spreadsheets do not provide many options for controlling access to prevent information loss.

Reporting complexity: Exception reports are only as useful as the accuracy of the data within them. Administrative staff could spend hours per month verifying data and distributing reports, which ultimately provide minimal value if data is unreliable.

Disconnect from imaging: Some financial institutions implement document imaging systems but continue using spreadsheets for exception tracking. In such scenarios, loan administrators must remember to update the exception spreadsheet after scanning or uploading each document.

Lack of scalability: Tracking a handful of commercial loans in a spreadsheet may be doable, but scaling this approach for hundreds of accounts and dozens of lenders isn’t easy.

Finding a Solution that’s Optimized for Exception Tracking

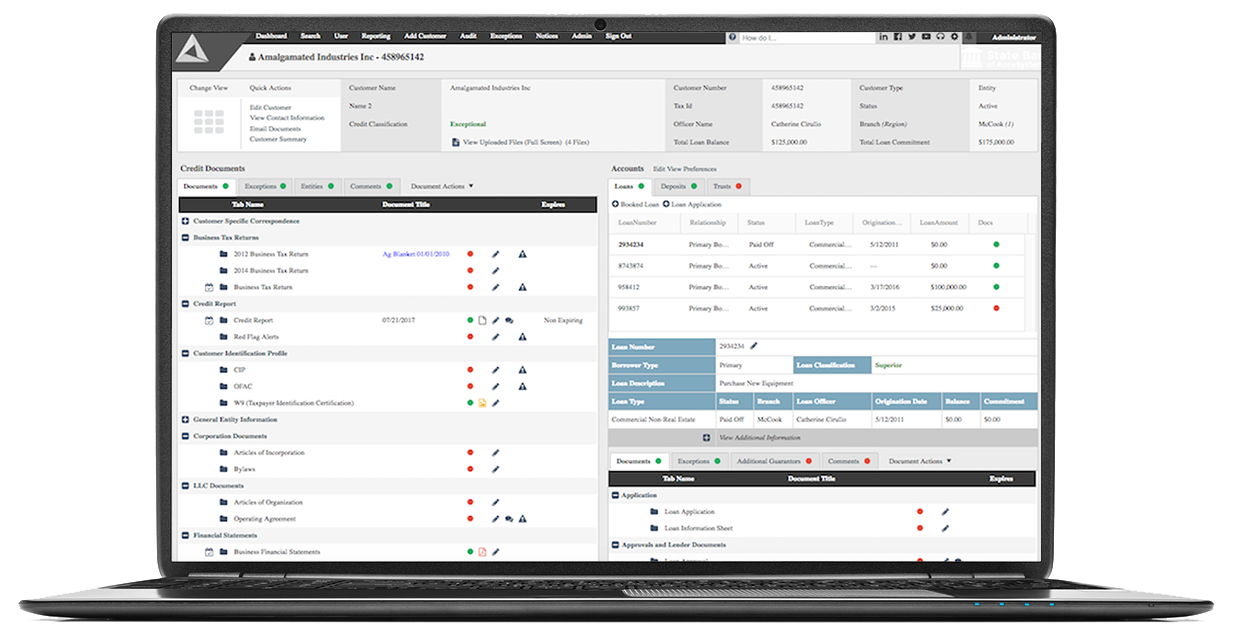

Consolidating your tracking and imaging workflows into a system like AccuAccount can make it easier to identify exceptions, reduce missing and expiring documents, and increase efficiency. AccuAccount is a document management system that’s built for the unique needs of financial institutions involved in commercial lending. Here’s a brief overview of our solution:

Intuitive Design & Structure

AccuAccount was built to “look like” a traditional loan file with customer or member information at the top, credit on the left, and accounts on the right side of the screen. Visual indicators (red and green) help users quickly spot items that are missing.

Document placeholders populate automatically, reducing administrative work and lessening the chance of data entry errors.

Exception Management Tools

AccuAccount supports a variety of exception tracking use cases: missing documents, expiring documents, loan policy exceptions, and task exceptions. Prebuilt exception reports and dynamic reporting save credit and loan admins hours of work. Resolving an exception is as easy as dragging and dropping a document into the correct location.

Automation

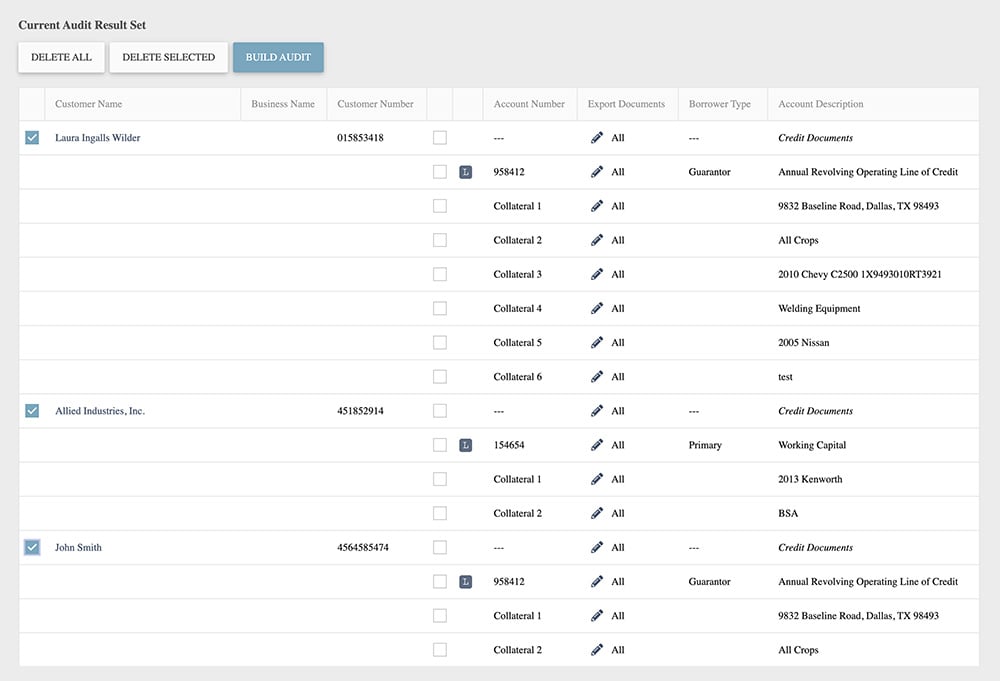

Easily configure daily or weekly exception emails to automatically keep lenders, loan assistants, and other stakeholders informed about pending exceptions. Quickly generate notice letters or send email notices for increased visibility. Prepare for audits and exams in minutes—not days—with AccuAccount.

Is Now the Right Time to Upgrade Your Exception Workflow?

Switching from spreadsheets to AccuAccount is a strategic decision that requires careful consideration and input from multiple stakeholders at your financial institution. If your bank or credit union is expanding its commercial lending operations and making increasingly complex loans, now might be a good time to start an internal conversation.

Contact us to learn more about AccuAccount

How Much is Exception Tracking Costing your Institution?

Find out: Download a free cost calculator

Be the first to know! Click below to follow us on LinkedIn for news and content updates!