[Playbook] Managing Policy Exceptions in AccuAccount

Here’s the Situation: Your financial institution needs a better way to track policy exceptions. In the past, your team has used spreadsheets for loan policy tracking. Although spreadsheets offer a familiar experience for staff, they pose several challenges—especially when it comes to generating exception reports.

This article shares an easy way to use AccuAccount for loan policy exception management. Not an AccuAccount user yet?

Here’s the Game Plan

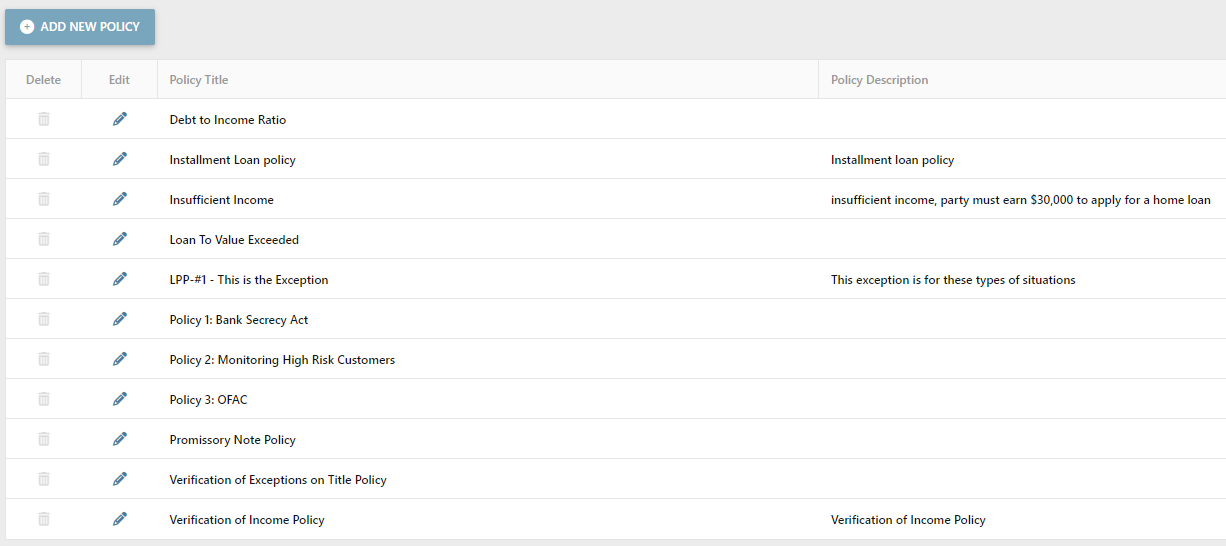

Step 1: Ask your system administrator to update the “policy exception maintenance” section of AccuAccount. (Click “policy exception maintenance” from the “exceptions” menu to view).

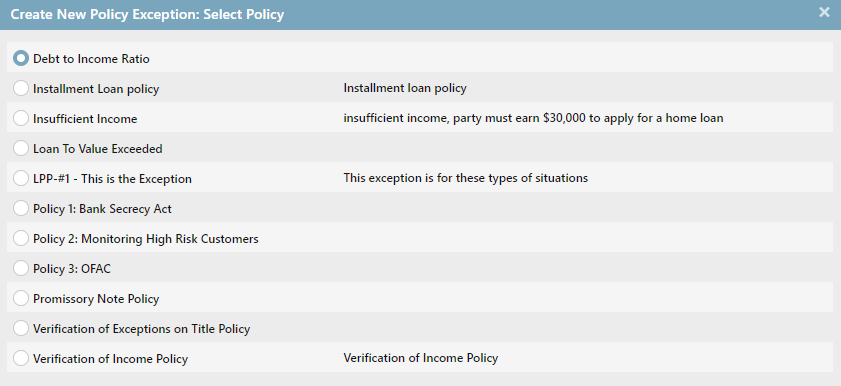

Step 2: Now, staff with proper permission can begin adding policy exceptions for specific loans. Simply navigate to the customer or member’s file in AccuAccount and locate the correct loan. Click the “P” icon located on the “exception tab” and then select the correct policy exception.

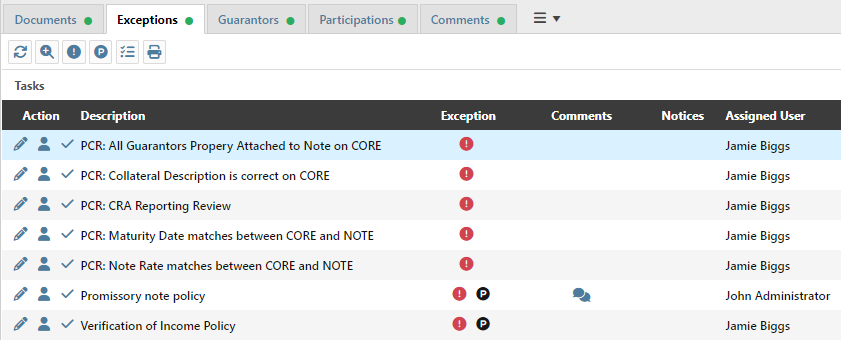

Step 3: Applying a policy exception adds a “P” icon to the loan’s record. In this example, policy exceptions have been applied for the promissory note and verification of income requirements.

Step 4: Staff can easily view and subscribe to (via email) prebuilt policy exception reports—no spreadsheets required!

Streamline Policy Exceptions

Managing policy exceptions in AccuAccount is more efficient and scalable than doing so in spreadsheets. Take the next step toward streamlining your financial institution’s tracking workflow.

Contact us to learn about exception management capabilities in AccuAccount

Be the first to know! Click below to follow us on LinkedIn for news and content updates!