[Playbook] Early Capture in AccuAccount

Here’s the Situation: Your financial institution wants to leverage early capture to improve efficiency and reduce commercial lending bottlenecks. For years, you’ve used AccuAccount to image, manage, and track commercial loan and credit documents. Now, you’re looking to capture documents before booking loans to the core.

This article shares two “plays” for early capture in AccuAccount.

Play #1: Manually Adding a Loan

Connecting your core makes it possible to automate the creation of loans and accounts in AccuAccount. That said, users still have the option to manually add new loans in AccuAccount—independent from automated workflows. Here’s how this play works.

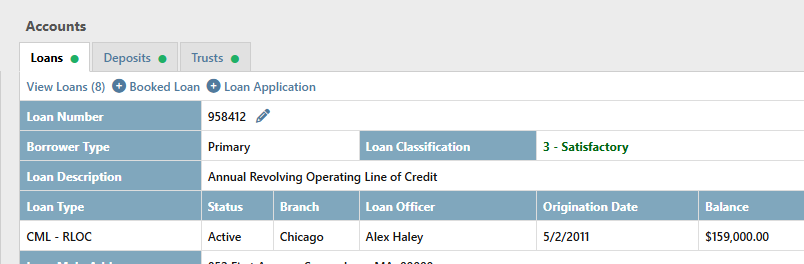

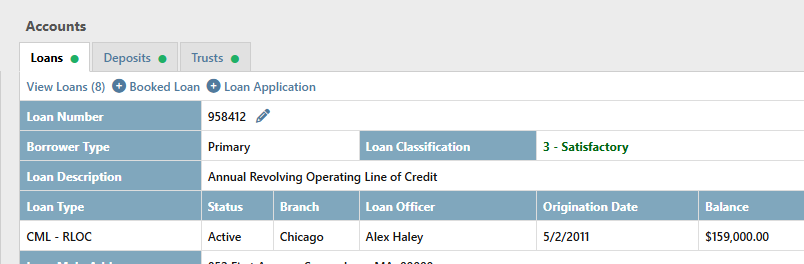

Step 1: View the customer or member’s page in AccuAccount and click the link to add a new loan. (The link text says “booked loan,” but following this workflow does not book anything to the core.)

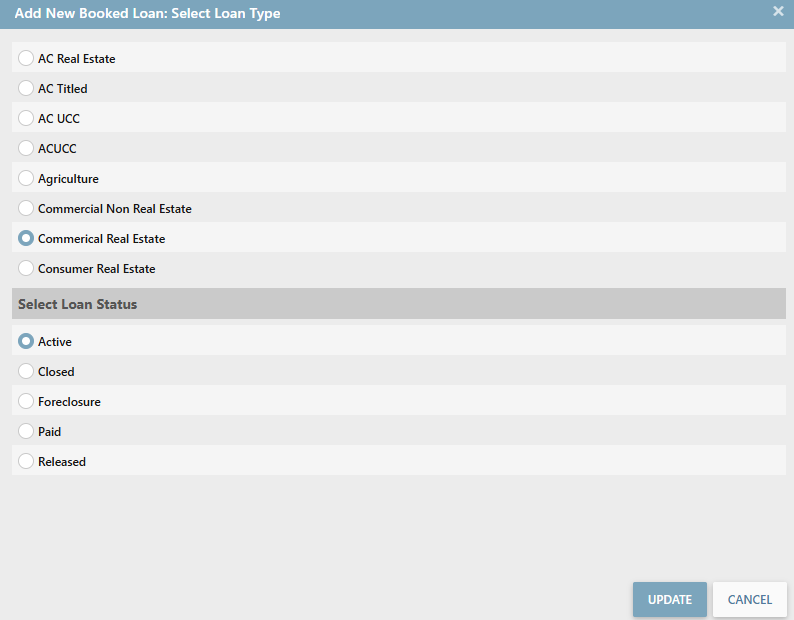

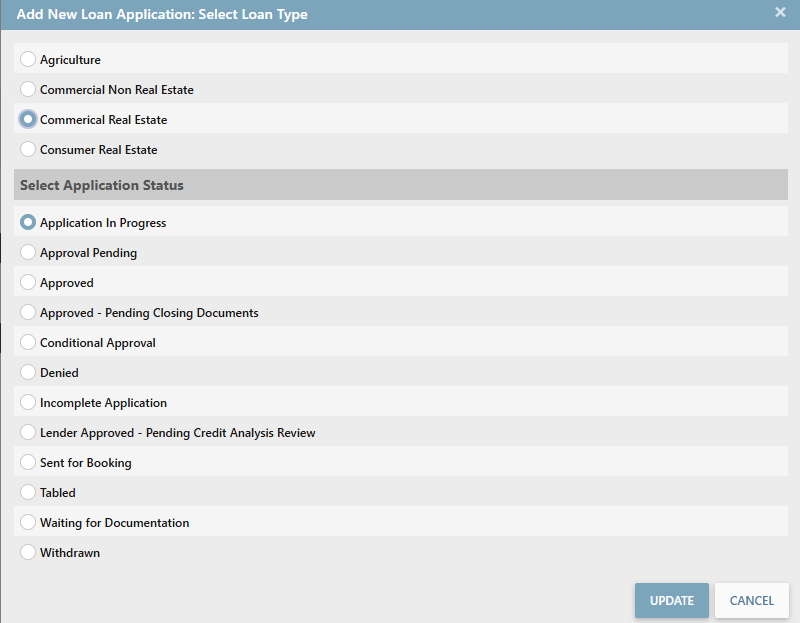

Step 2: You’ll be prompted to indicate loan type (commercial real estate, agricultural, etc.) and status. Consider asking your admin to add a custom status option, such as “pending” or “pre-booking” to avoid confusion with already-booked loans.

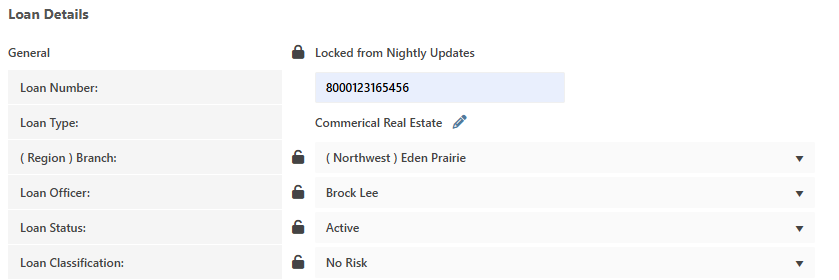

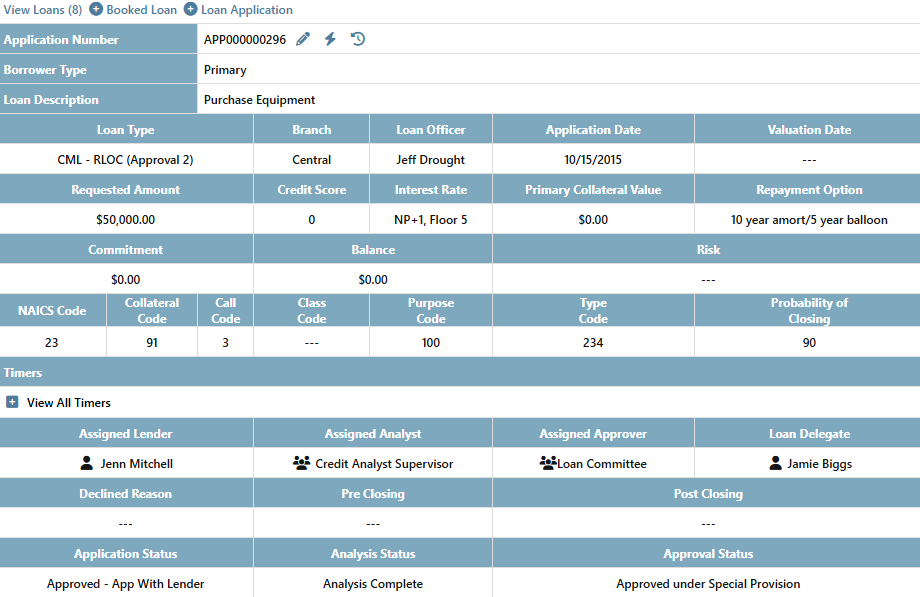

Step 3: Next, you’ll enter basic details about the loan. No loan number yet? Some financial institutions use a temporary id that is replaced after booking. Click the “update” button to save your work.

Step 4: Once the loan has been manually added in AccuAccount, you’ll be able to scan or upload documents. As with other loans in AccuAccount, the file will be prepopulated with document placeholders for that particular loan type.

What happens after the loan is actually booked? Simply update the temporary loan number with the actual number so AccuAccount knows where to save data from the core. Don’t worry if you forget to do this prior to booking, which would create a duplicate loan record in AccuAccount. Just update the loan number, delete the duplicate, and everything will be ready for the next nightly sync.

Play #2: Using AccuApproval

AccuApproval is a module for AccuAccount that’s built specifically for loan approvals. Early capture in AccuAccount is even easier when done in tandem with AccuApproval. The basic steps are similar to the first play with a few exceptions:

Instead of adding a new loan, users simply add a new “loan application.”

The next screen resembles the “select loan type” screen shown above, but the options are more tailored to an in-process loan.

Users are prompted to provide additional information about the potential loan.

Now team members can begin scanning and uploading files for early capture. AccuApproval also enables efficient loan file routing to lenders, credit analysts, underwriters, and senior management, who can view related documentation from their workstations. That means less paper, increased productivity, and, ultimately, an enhanced lending workflow.

Capture Loan Documents Sooner

See why more than 15,000 bankers use AccuAccount, Alogent’s ECM solution that’s optimized for commercial lending.

Contact us to schedule a demo of our early capture capabilities

Be the first to know! Click below to follow us on LinkedIn for news and content updates!