With Delinquencies on the Rise, It’s Time to Rethink Collateral Perfection & Risk Management

Delinquent loans seem to be on the rise at financial institutions across the United States. In fact, the NCUA reported that the delinquency rate at federally insured credit unions during Q3 2023 was up 19 basis points versus the previous year. The Federal Reserve Bank of New York noted similar trends around loans in "serious delinquency," defined as those delinquent for 90-days or more - auto loan debt (2.22% in Q4 2022 vs. 2.66% in Q4 2023), credit card debt (4.01% in Q4 2022 vs. 6.36% in Q4 2023) and "other" loan debt (3.96% in Q4 2022 vs. 5.15% in Q4 2023), to name a few.

Such trends may indicate macroeconomic difficulties, but they also pose risks for the financial institutions themselves. With delinquencies on the rise, now might be a smart time to revisit your collateral perfection and risk management practices. This article explores how Alogent’s AccuAccount can help your bank or credit union achieve enhanced workflows.

“Perfecting” Your Collateral Perfection

For those new to the banking world, collateral perfection is a process that helps a financial institution protect its ability to take ownership of collateral if default occurs. Obviously, ensuring that loan agreements contain proper language is a necessary step, but it’s not the only step. Financial institutions must also collect and manage a variety of documentation as part of the collateral perfection process. From UCC financing statements to certificates of insurance and deeds of trust, a single loan might involve multiple collateral-related documents and stakeholders. Some documents may be collected only once, while others must be obtained on an ongoing basis. Staying on top of all of this complexity leads to considerable administrative work for staff—and numerous opportunities for oversights.

How AccuAccount Helps: AccuAccount is a document management system that’s built for the specific needs of financial institutions. Although commercial lending is a primary reason why banks and credit unions implement AccuAccount, the system is capable of adapting to the needs of consumer loans, mortgages, and other loan types. Here are a few ways that AccuAccount can help you “perfect” your collateral perfection process.

- Collateral document placeholders can be configured to automatically appear as new loans are booked to your core, thereby reducing reliance on checklists and manual data entry.

- Integrated exception tracking ensures that missing documents remain top of mind through emailed exception reports and dashboards. Clearing an exception is as easy as uploading a missing document to AccuAccount.

- Digital access to collateral documents and exception data empowers staff with information to engage stakeholders and support ongoing collateral perfection requirements.

- Document expiration dates help teams remember to take action in advance of time-sensitive renewals, such as UCC financing statements.

Proactively Managing Risk

Borrowers’ financial situations can change due to unexpected shifts in market conditions, interruptions in business operations, cash flow challenges, and many other reasons. Financial institutions rely on risk ratings to efficiently identify loans that represent higher risk. However, connecting this risk rating data with exception data often requires manual data joins, which delays customer or member engagement and exception resolution.

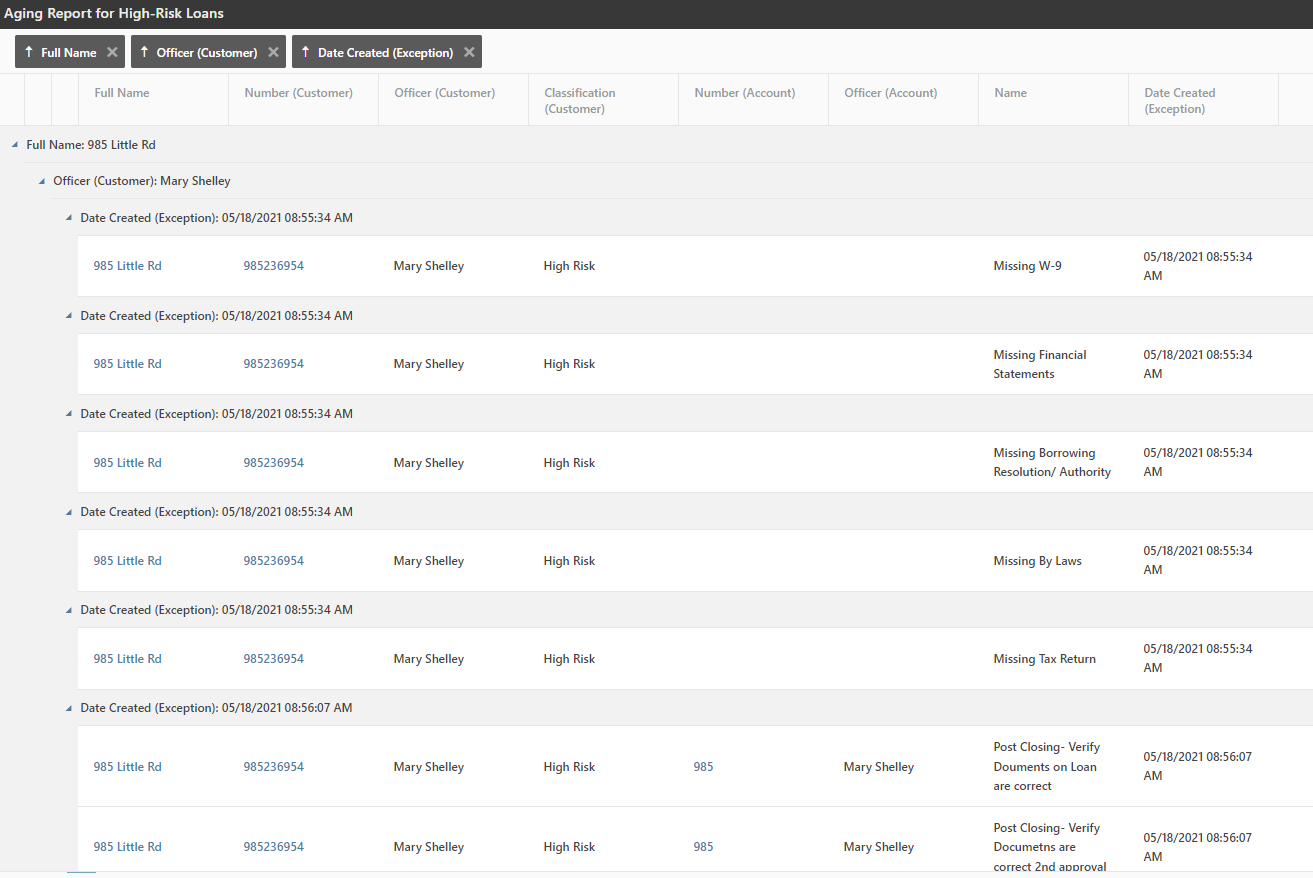

How AccuAccount Helps: Importing risk rating data into AccuAccount provides a convenient way to analyze risk rating and exception data in a single view. With Dynamic Reporting for AccuAccount, staff can build custom reports to identify high-risk loans with outstanding document requirements. Easily sort, filter, and export data to create an actionable game plan in a matter of minutes—instead of building pivot tables in spreadsheets. AccuAccount also provides built-in notice generation capabilities, saving even more time compared to mail merges.

Contact Alogent to explore all that AccuAccount has to offer, including collateral document management, exception tracking and reporting, and system integrations.

Interested in learning more about AccuAccount? Check out our solution overview!

Be the first to know! Click below to follow us on LinkedIn for news and content updates!