How to Enable Better Experiences for Multiple Stakeholders with Streamlined Document Management

Document management is often considered a “back-office” function that minimally impacts a financial institution’s key business objectives. In reality, streamlined document management can play a key role in driving operational efficiency and fostering healthier relationships with customers, members, auditors, and examiners.

Alogent’s webinar, Instantly Find, View, and Share Documents with AccuAccount, explored how to leverage effective document management to engage multiple stakeholders. Let’s take a closer look.

Commercial Lending Customers

Here’s the situation: John needs a line of credit to acquire a new piece of equipment for his business. It’s a great deal, and John is excited to make the purchase. Unfortunately, John’s office manager is out on vacation, and he doesn’t have access to some of his business documents. John hopes that his commercial lender has enough documentation on file to kick off the application process.

John calls his lender and learns that he can get things moving sooner rather than later. John’s bank uses AccuAccount, which makes it easy for the lender to search for, find, and view existing credit documentation.

During the call, John’s lender mentions that his timing was good for another reason—the bank needs an updated tax form and quarterly financial statement. John receives an email containing the lender’s portal link, which he promptly forwards to his office manager. After returning from vacation, John’s office manager uploads the documents, which the lender drags and drops into AccuAccount—clearing the exceptions and triggering downstream notifications to participating financial institutions.

Deposit Account Holders

Here’s the situation: Frieda is on vacation and needs some extra cash for her trip. Her credit union has a branch within a few miles of the hotel, so she stops in to deposit a check and make a withdrawal.

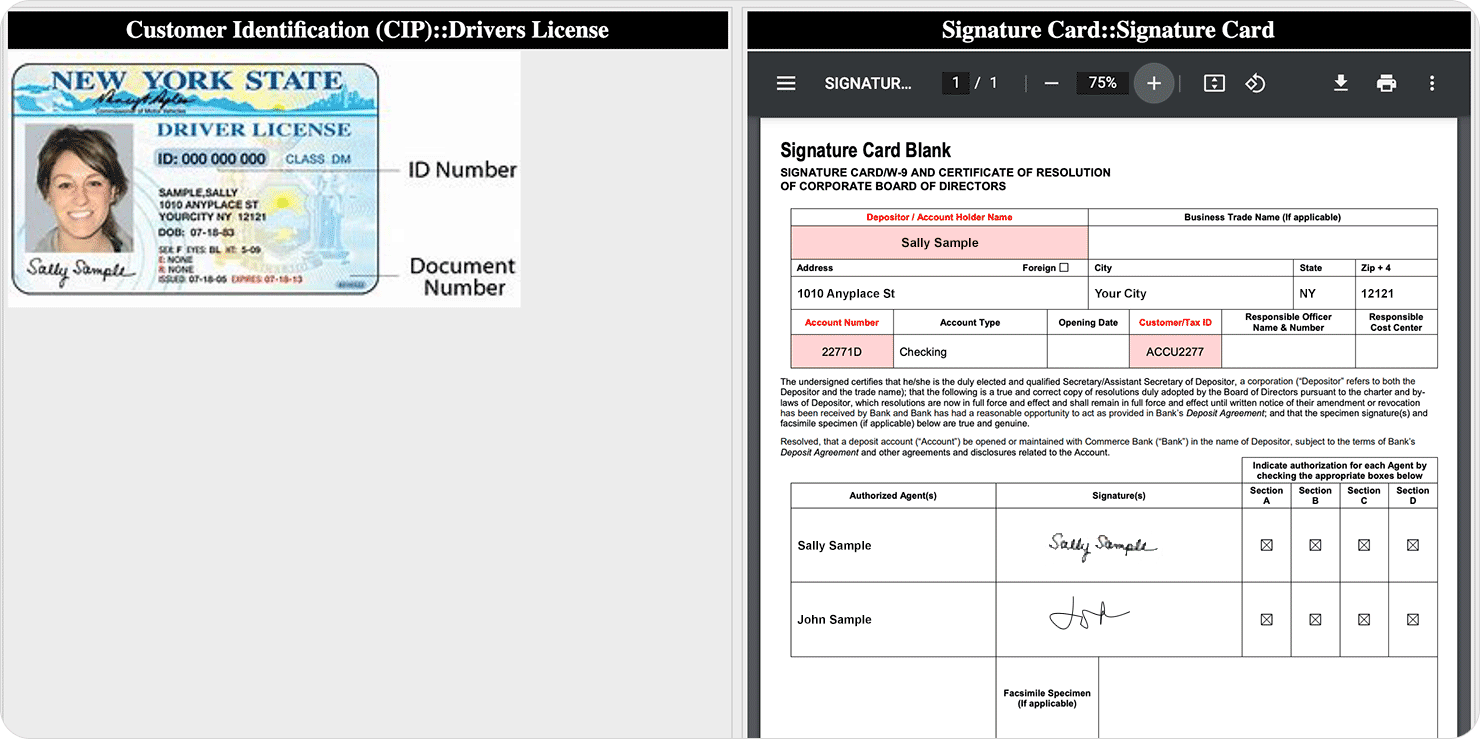

Frieda is pleased to experience the same great service that she receives at her home branch. Part of the reason is that her credit union uses AccuAccount, which offers a side-by-side teller view. Tellers can easily access and verify Frieda’s information in a single, intuitive view. There’s no need to call the main branch for additional information—it’s right there in AccuAccount.

Frieda has the cash she needs to enjoy the rest of her trip, and it only took a few minutes of her time.

Examiners & Auditors

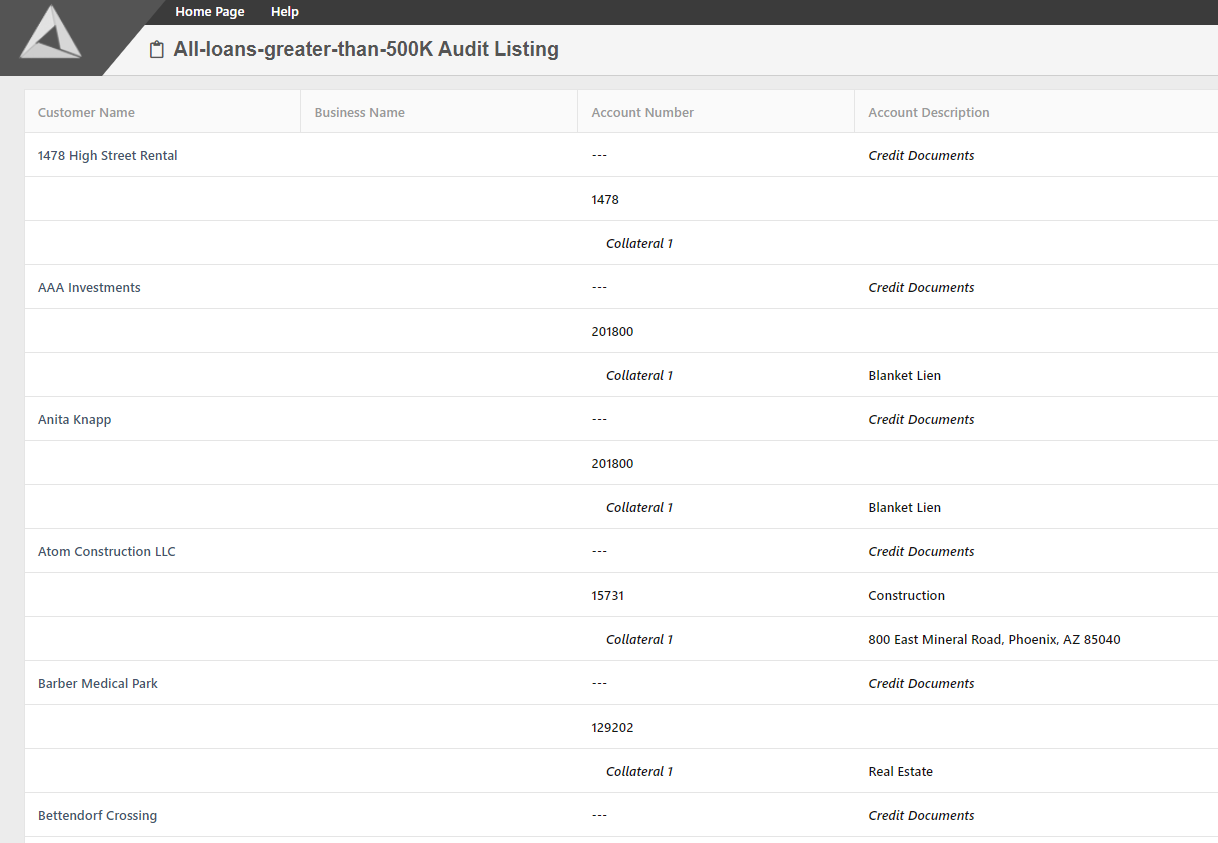

Here’s the situation: You’re a loan administrator at a community bank, and today you’re visited by an examiner. The examiner requests access to all images for loans with balances greater than or equal to $500,000.

AccuAccount enables you to easily search for and select all loans that match the examiner’s criteria. In just a few minutes, you’ve built an electronic audit file that provides the examiner exactly what she’s looking for—no more, no less.

Sharing the audit file with the examiner is easy, too. Just export it to a disk or thumb drive, or share access via secure FTP or VPN.

Gain Efficiency by Streamlining Your Document Management

Streamlined document management represents an excellent opportunity to elevate experiences for internal and external stakeholders—from commercial lending customers to account holders and examiners.

Take a tour of AccuAccount and all of Alogent’s process automation solutions.

Be the first to know! Click below to follow us on LinkedIn for news and content updates!