How to Get More Done with Your Desktop Scanner (& AccuImg)

Large quantities of paper documents arrive daily at financial institutions. Despite the shift to digital, banks and credit unions still need a scalable way to manage the seemingly constant flow of financial statements, tax returns, insurance documents, and other information. Many financial institutions have already adopted document management systems, yet some still struggle to overcome recordkeeping headaches.

To enable efficient loan document management, banks and credit unions should implement solutions that eliminate bottlenecks and drive greater adoption from stakeholders. At Alogent, we’re continually looking for ways to empower customers and drive increased ROI from our solutions. Alogent’s desktop scanning software for AccuAccount, AccuImg, accomplishes this by making it easier for users to participate in the loan imaging process.

Let’s explore how AccuImg can help you increase efficiency through streamlined desktop scanning.

Multi-Function Devices vs. Desktop Scanning

Although multi-function devices tend to have higher throughputs, they’re typically more expensive to acquire and less prevalent than desktop scanners. This presents a number of document imaging challenges:

Scanning bottlenecks: Scanning multiple loan files might require considerable time and effort for a loan administrator. What happens when another team member needs to use the same multi-function device for batch scanning or running copies? Someone has to wait.

Knowledge gaps: Multi-function devices offer a lot of capabilities, but more capabilities means more buttons, more settings, more mechanical components that can break, and a much steeper learning curve for users. Compared to multi-function devices, using a desktop scanner is fairly straightforward—even for users who are less than tech-savvy.

Downtime: Downtime can cause a branch to fall way behind, especially if most documents are scanned through a single, multi-function device. However, a branch that leverages multiple desktop scanners is better suited to pick up the slack.

Based on these factors, it seems like the smart play involves a mix of multi-function devices and desktop scanners. Unfortunately, desktop scanning presents its own set of challenges—especially when a bank or credit union relies on antiquated desktop scanning software. Scanning documents one page at a time, juggling clunky PDF editing tools, and building homegrown integrations between apps is frustrating and delays imaging workflows.

Increasing Efficiency through Desktop Scanning

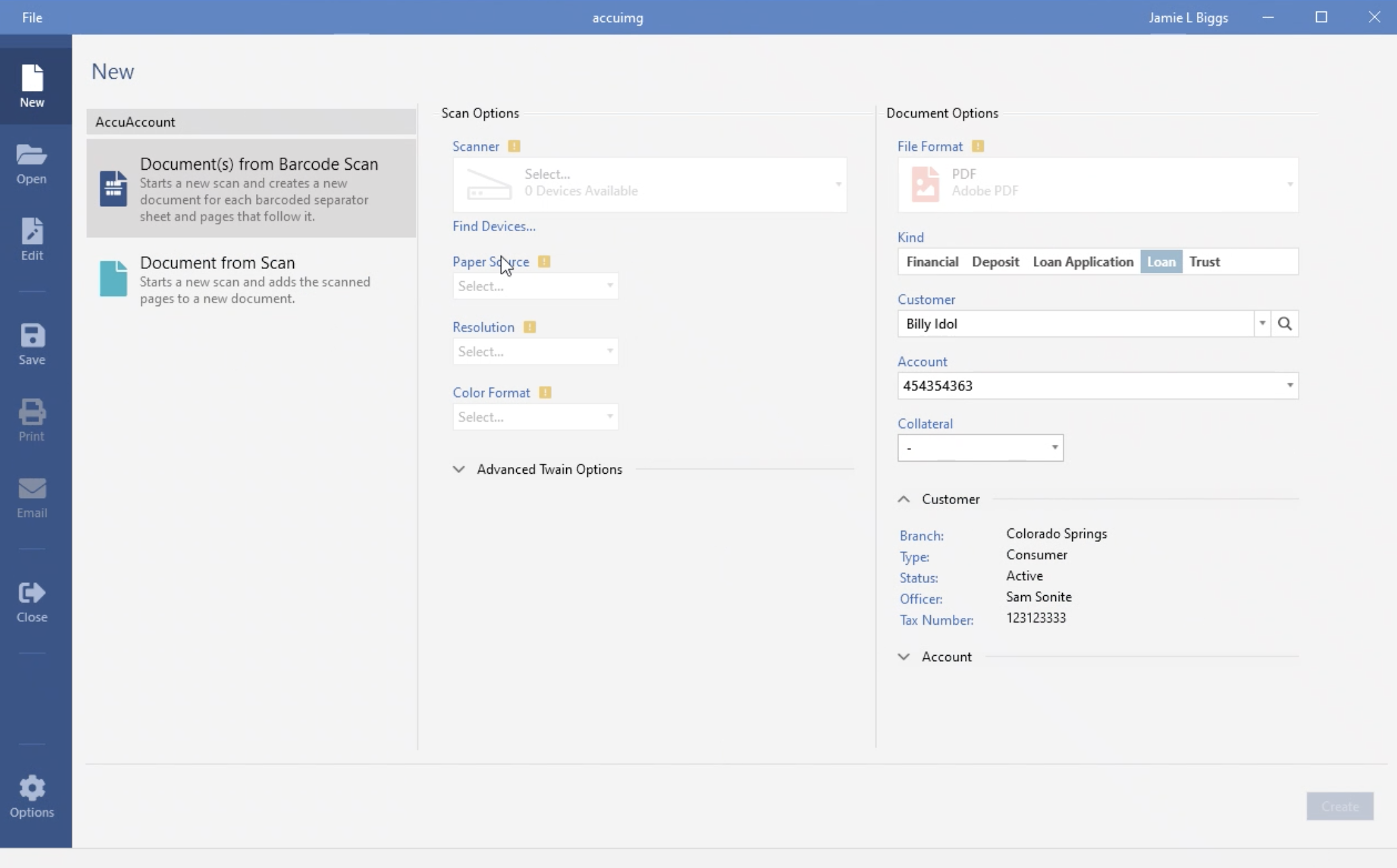

By using our AccuImg solution in tandem with AccuAccount, banks and credit unions can elevate their desktop scanning and imaging processes while lessening their dependence on multi-function devices. Financial institutions can use AccuImg to accelerate a variety of desktop scanning use cases, including:

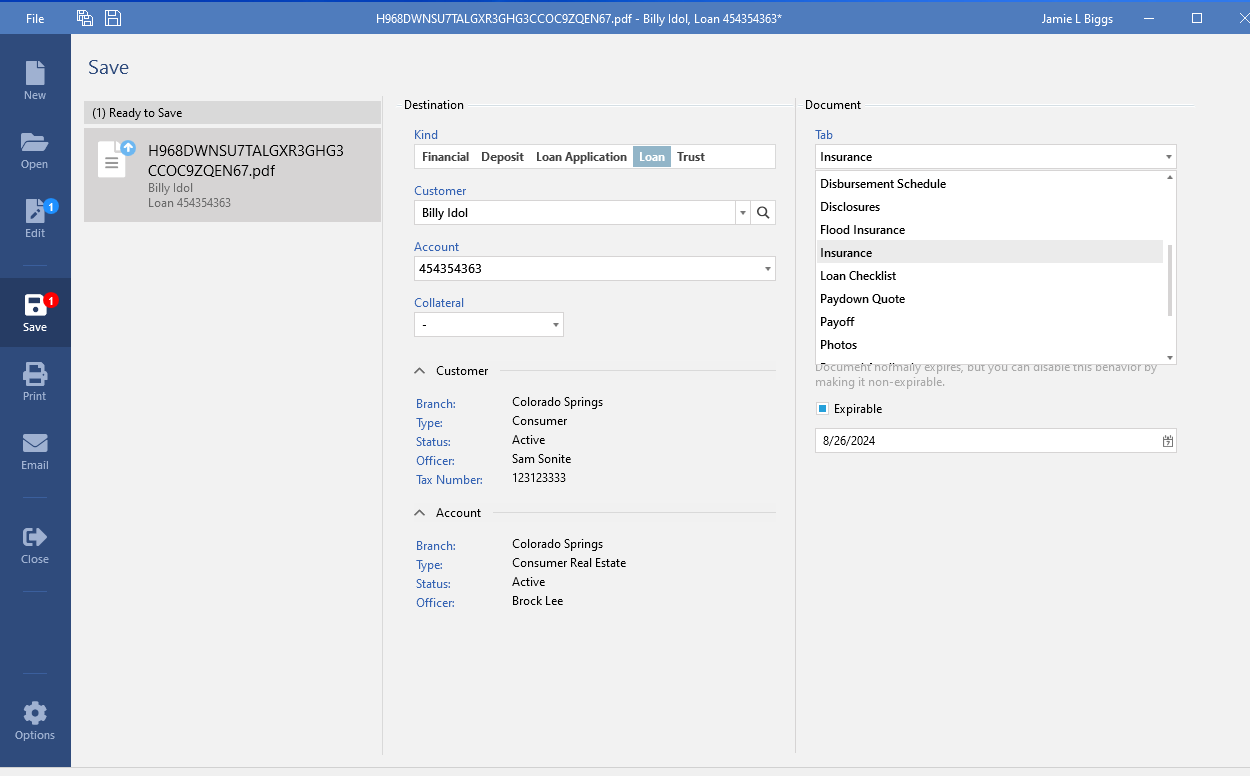

One-off document scanning, such as when you receive a new insurance document for a customer or member. Just launch AccuImg, follow the prompts, enter the appropriate customer or account information, and save your work to AccuAccount.

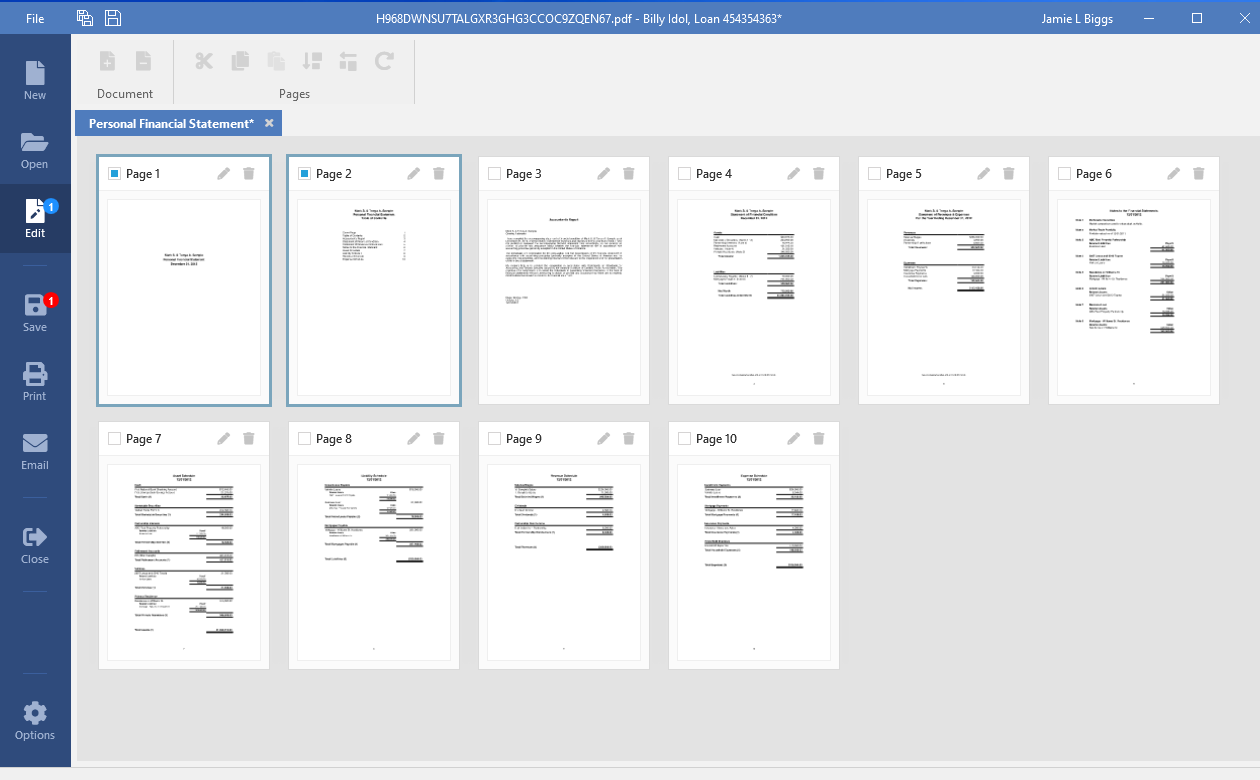

Batch document scanning for when you have a huge stack of paper documents from a variety of customers or members. Use AccuImg to digitize and electronically organize, combine, or adjust scanned-in documents prior to saving them to AccuAccount.

Barcoded document scanning, such as when you need to digitize multiple barcoded loan documents from your document preparation system.

Bonus: Use AccuImg for Electronic Documents, Too

Desktop scanning isn’t the only use case for AccuImg. You can also use it to work through your electronic document backlog and capture email attachments into AccuAccount. Drag and drop functionality in AccuImg is particularly handy for these use cases.

Continue Reading About AccuImg

Interested in learning best practices for AccuImg? Check out some of our playbooks, including:

Contact us to schedule a demo of AccuAccount, AccuImg, or one of Alogent’s other process automation solutions.

Be the first to know! Click below to follow us on LinkedIn for news and content updates!