Gaining a Holistic View of Banking Relationships with AccuAccount

Banking relationships can be incredibly complex. After all, one commercial customer might be connected to dozens of entities, loans, and accounts. To see the bigger picture, some financial institutions rely on time-consuming data manipulation in spreadsheets. It doesn’t have to be that way.

Implementing AccuAccount from Alogent can make it easier to understand banking relationships and reduce administrative work. AccuAccount brings together key relationship information from loans, collateral, guarantors, credit, related entities, and accounts—resulting in a powerful, intuitive platform for team members.

Meet “Customer View” in AccuAccount

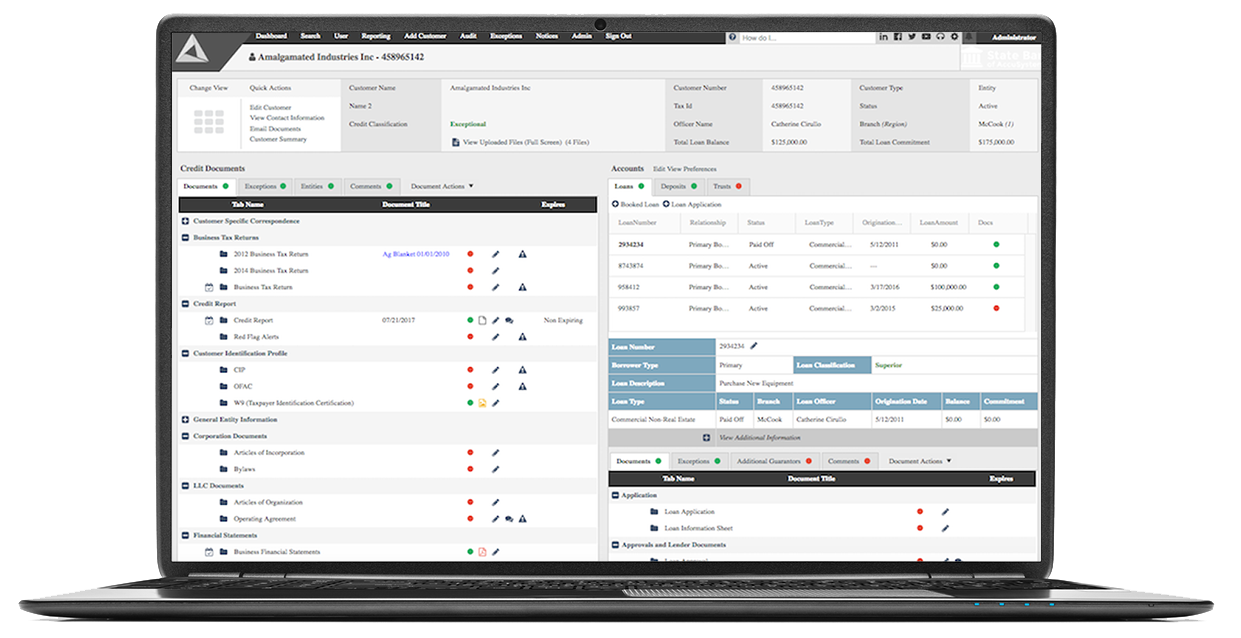

AccuAccount was built to “look like” a traditional loan file. Our “customer view” provides at-a-glance information across the top, credit on the left, and loans and accounts on the right.

With just a few clicks of the mouse, employees with proper access can find the information they need from the digital customer file:

Data from the Core, including the customer’s name, number, tax id, loan balance and commitment amounts.

Credit Documents, such as financial statements, CIP, organizational documentation, credit authorizations, as well as related exception data.

Related Entity Information, including each related entity’s name, outstanding balance, and commitment amount.

Loans and Collateral Information, including loan number, loan type, origination date, loan officer, as well as documentation and exceptions. AccuAccount also makes it easy to track cross-collateralized loans.

Guarantor information is also linked from each loan in AccuAccount. Drilling down into a guarantor’s file provides staff with detailed insights about the relationship.

Deposit Account Records, such as electronic copies of drivers licenses, signature cards, account documentation, as well as related exception information.

Trust Account Records, such as scanned-in receipts, bills, tax returns, bank statements, court documents, and benefit statements.

See a Demo of AccuAccount

Is your bank or credit union looking for a better way to manage relationships? Perhaps it’s time to take a closer look at AccuAccount. Watch a pre-recorded demo on our AccuAccount overview page or request a personalized demo.

Be the first to know! Click below to follow us on LinkedIn for news and content updates!