Enabling "Person-Centric" Experiences with AccuAccount Views

Customers and members expect to be treated as unique individuals—not as account numbers. Unfortunately, gaining a comprehensive view of each relationship isn’t easy. Organizing account holder information by document type or identification number is common in banking, but doing so inhibits person-centric experiences. Is there a better option?

Implementing AccuAccount, Alogent’s ECM solution that’s optimized for commercial lending, makes it easier to deliver person-centric interactions with customers and members. Let’s look at two AccuAccount “views” that help staff keep relationships front and center.

Customer (or Member) View in AccuAccount

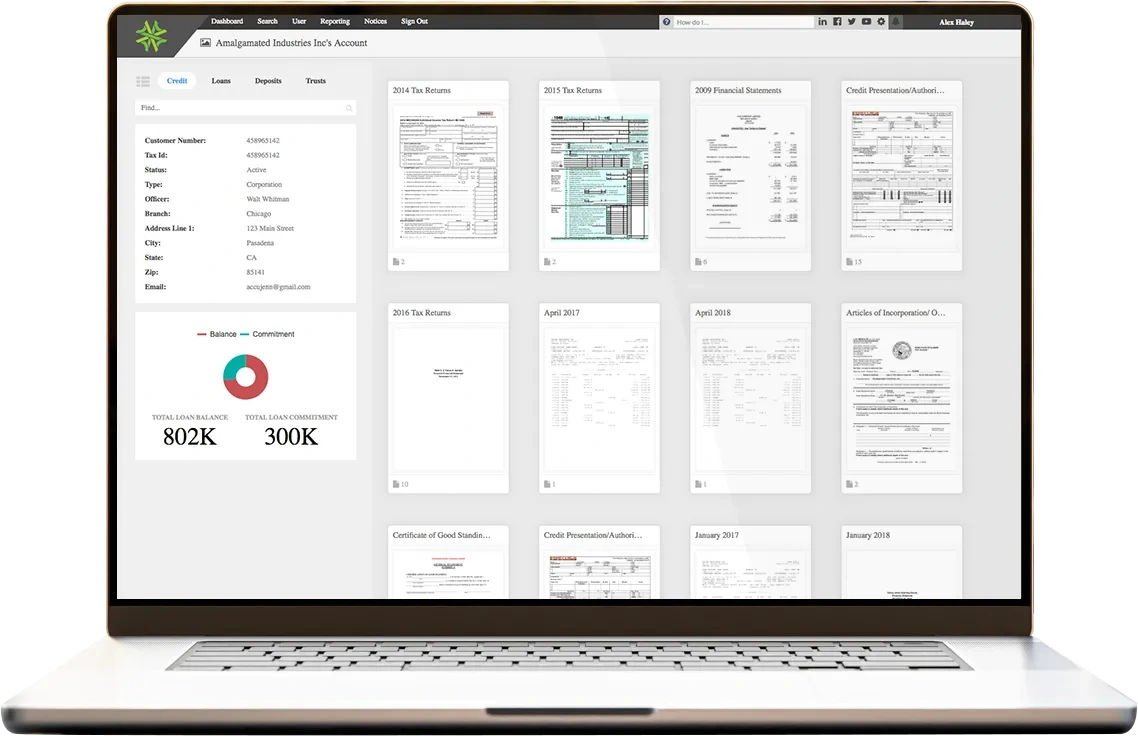

AccuAccount was designed to “look like” a traditional loan file. Credit information is located on the left side, while loans and accounts are accessible on the right. In addition, important relationship data from the core—such as identification numbers, total loan balance information, and total loan commitment—is conveniently visible at the top.

Finding the customer or member’s page in AccuAccount is fast and easy, requiring a simple search by name. From there, staff can quickly view credit documents, loans, collateral, related entities, guarantors, and exceptions. Deposit and trust account data can also be made available.

Key benefit: Accessing customer or member information from a single page puts staff in a better position to understand relationships, provide enhanced service, and enable person-centric experiences.

Document View in AccuAccount

Documents serve a crucial role in today’s banking environment. From loan applications to borrower financial statements and insurance records, banks and credit unions must generate, request, collect, and store a lot of documents. Many interactions with customers or members involve one or more documents, which is why “document view” in AccuAccount is especially useful.

Document view provides a visually intuitive way to browse, search for, and view documents that are related to specific people and businesses. For example, a commercial lender might use document view to verify that a borrower’s tax return has been received. Keying in the word “tax” would filter the customer’s documents to only show those items containing that keyword. Other staff might use document view to efficiently answer document-related questions or complete quality control tasks.

Key benefit: Streamlined access to documents empowers staff to rapidly find information and reduce wait times for customers or members, thereby emphasizing the institution’s commitment to excellent service.

Explore Alogent’s Person-Centric ECM Solutions

Take the next step toward person-centric banking with Alogent’s suite of ECM solutions. Simplify loan management and exception tracking with AccuAccount. Accelerate your digital transformation and unlock self-service with FASTdocs.

Contact us to schedule a software demo

Be the first to know! Click below to follow us on LinkedIn for news and content updates!