Consumers Need Branches, and Branches Need Advanced Technology to Stay Affordable

Alogent closely follows shifts in bank and credit union branching, especially declining branch transaction volumes, increasing staffing costs, and the resulting need for ever-greater efficiency in transaction workflows.

Our recent white paper, Investing in Teller/Front Counter Capture, updates recent data on one important of the branching equation: the true cost of image capture technology. You can download our paper to read about life cycle costs you may not have considered—or reconsidered lately.

A new study that supports our conclusions is now available from Kronos. The FMSI 2017 Teller Line Study is based on over 15 million teller transactions at banks and credit unions across the U.S. It focuses on staffing strategies—which they call human capital management---for your branching plans. Their detailed productivity recommendations are definitely worth a look.

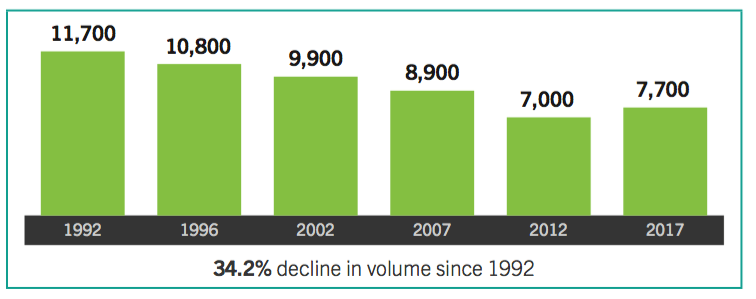

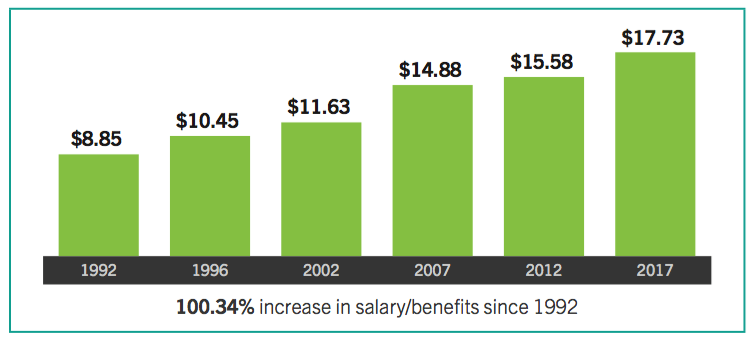

The study’s twin 26-year trendlines paint a vivid picture.

Hiding within these quarter-century trends are huge changes in the entire banking environment, such as shifts to new payment methods, the rise of mobile and online banking, and branch closings, consolidations, and redesigns.

Does the overall volume drop of 34.2% surprise you? What about the slight increase in monthly volume in the past five years? And does this mean teller transaction are again becoming more valuable to accountholders?

J. D. Power’s Retail Banking study concluded that physical branches will remain important for what they call “moment of truth” services, and the FMSI study further suggests that, “financial institutions would be well advised to invest in technology that makes each branch experience as satisfying as possible for the account holder.”

To our way of thinking, this means leveraging both digital and in-person interactions, and making them seamless and friction-free. And with the balance of digital and transactions leveling out, the real question shifts from whether to keep branches, to determining the best mix of online banking and physical locations.

How are these trends playing out in your organization?

Teller capture technology is one way to optimize your valuable staff resources, and our white paper guides you through a total cost look at why investing in branch solutions has never been more timely.